The following data are for Rocky Company.

Current Year / 1 Year Ago

Accounts receivable, net...

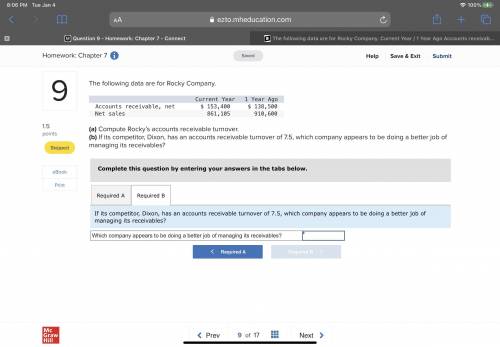

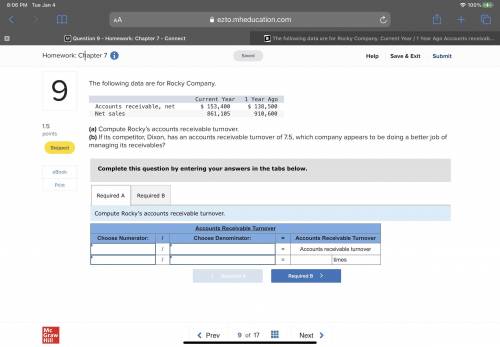

The following data are for Rocky Company.

Current Year / 1 Year Ago

Accounts receivable, net $ 153,400. / $ 138,500

Net sales 861,105. / 910,600

(a) Compute Rocky’s accounts receivable turnover.

(b) If its competitor, Dixon, has an accounts receivable turnover of 7.5, which company appears to be doing a better job of managing its receivables?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:20, ktenz

Miller mfg. is analyzing a proposed project. the company expects to sell 8,000 units, plus or minus 2 percent. the expected variable cost per unit is $11 and the expected fixed costs are $287,000. the fixed and variable cost estimates are considered accurate within a plus or minus 5 percent range. the depreciation expense is $68,000. the tax rate is 32 percent. the sales price is estimated at $64 a unit, plus or minus 3 percent. what is the earnings before interest and taxes under the base case scenario?

Answers: 1

Business, 22.06.2019 21:00, shawntawright1

On july 2, year 4, wynn, inc., purchased as a short-term investment a $1 million face-value kean co. 8% bond for $910,000 plus accrued interest to yield 10%. the bonds mature on january 1, year 11, and pay interest annually on january 1. on december 31, year 4, the bonds had a fair value of $945,000. on february 13, year 5, wynn sold the bonds for $920,000. in its december 31, year 4, balance sheet, what amount should wynn report for the bond if it is classified as an available-for-sale security?

Answers: 3

Business, 23.06.2019 02:50, Lacrosse34

Which of the following will be a source of cash flows for a shareholder of a certain stock? i. sale of the shares at a future date ii. the firm in which the shares are held paying out cash to shareholders in the form of dividends iii. the firm in which the shares are held increasing the total number of shares outstanding through a stock split

Answers: 2

You know the right answer?

Questions in other subjects:

Social Studies, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

Chemistry, 12.02.2021 14:00