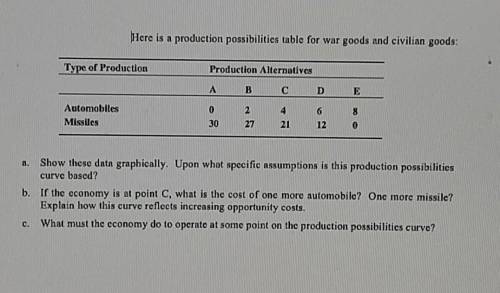

Here is a production possibilities table for war goods and civilian goods: Type of Production Production Alternatives B D E Automobiles Missiles 8 0 130 27. 21 12 Show these data graphically. Upon what specific assumptions is this production possibilities curve based? b. If the economy is at point C, what is the cost of one more automobile? One more missilo? Explain how this curve reflects increasing opportunity costs. What must the economy do to operate at some point on the production possibilities curve?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 06:20, isaiahcannon6158

About time delivery co. incurred the following costs related to trucks and vans used in operating its delivery service: classify each of the costs as a capital expenditure or a revenue expenditure. 1. changed the oil and greased the joints of all the trucks and vans. 2. changed the radiator fluid on a truck that had been in service for the past four years. 3. installed a hydraulic lift to a van. 4. installed security systems on four of the newer trucks. 5. overhaul the engine on one of the trucks purchased three years ago. 6. rebuilt the transmission on one of the vans that had been driven 40,000 miles. the van was no longer under warranty. 7. removed a two-way radio from one of the trucks and installed a new radio with a greater range of communication. 8. repaired a flat tire on one of the vans. 9. replaced a truck's suspension system with a new suspension system that allows for the delivery of heavier loads. 10. tinted the back and side windows of one of the vans to discourage theft of contents.

Answers: 1

Business, 22.06.2019 07:50, ShawnSaviro4918

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

You know the right answer?

Here is a production possibilities table for war goods and civilian goods: Type of Production Produc...

Questions in other subjects:

History, 06.09.2019 18:10

Mathematics, 06.09.2019 18:10

Mathematics, 06.09.2019 18:10

Mathematics, 06.09.2019 18:10

Mathematics, 06.09.2019 18:10