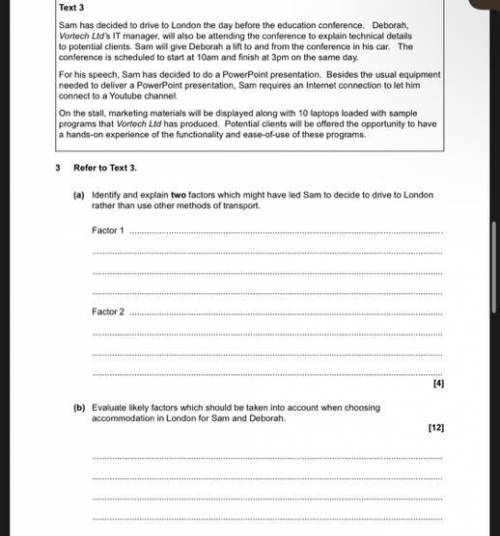

Please help me I’m stuck.

Thank you .

For both of the two questions I need help

...

Business, 06.12.2021 22:00 hewonabi123

Please help me I’m stuck.

Thank you .

For both of the two questions I need help

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:40, brooket30057

Morgana company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $168,000, $315,900, an $97,200, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,100, machine hours 24,300, and number of inspections 1,800. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

Business, 21.06.2019 21:40, jfarley259

The economic advisor of a large tire store proposes the demand function d(p)equalsstartfraction 1900 over p minus 40 endfraction , where d(p) is the number of tires of one brand and size that can be sold in one day at price p. answer parts (a) through (e) below. a. recalling that the demand must be positive, what is the domain of this function? the domain consists of all possible values of ▼ for which ▼ p d(p) ▼ does not exist. is positive. is zero. is negative. exists.

Answers: 3

Business, 22.06.2019 10:50, jadeafrias

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

You know the right answer?

Questions in other subjects:

Mathematics, 25.09.2020 02:01

Social Studies, 25.09.2020 02:01

Mathematics, 25.09.2020 02:01

Mathematics, 25.09.2020 02:01

Mathematics, 25.09.2020 02:01

History, 25.09.2020 02:01

Mathematics, 25.09.2020 02:01

Biology, 25.09.2020 02:01