1 pts

D

Question 1

Time Elapsed: Hide

Attempt due: Nov 19 at 1

3 Minutes,...

Business, 24.11.2021 07:10 haileesprague575

1 pts

D

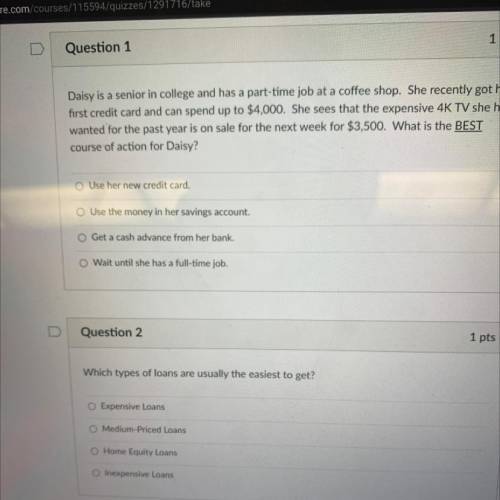

Question 1

Time Elapsed: Hide

Attempt due: Nov 19 at 1

3 Minutes, 9 Seconds

Daisy is a senior in college and has a part-time job at a coffee shop. She recently got her

first credit card and can spend up to $4,000. She sees that the expensive 4K TV she has

wanted for the past year is on sale for the next week for $3,500. What is the BEST

course of action for Daisy?

o Use her new credit card.

O Use the money in her savings account.

O Get a cash advance from her bank.

O Wait until she has a full-time job.

Question 2

1 pts

Which types of loans are usually the easiest to get?

O Expensive Loans

O Medium-Priced Loans

O Home Equity Loans

Inexpensive Loans

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 04:00, cameronbeaugh

Last week paul, ceo of quality furniture in south carolina, traveled to europe to visit customers. while overseas, paul checked his e-mail daily and showed his company's website to customers, explaining how the website will them place orders and receive merchandise more quickly. after visiting the last customer friday morning, paul was able to return to the corporate office in south carolina to meet with his board of directors that night. is the "shrinking" of time and space with air travel and electronic media.

Answers: 1

Business, 22.06.2019 08:00, kingyogii

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 08:40, Sk8terkaylee

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity. calculate the cost of new stock using the dividend growth approach. what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics. each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings. equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 14:00, tamariarodrigiez

How many months does the federal budget usually take to prepare

Answers: 1

You know the right answer?

Questions in other subjects:

Mathematics, 29.01.2020 12:51

History, 29.01.2020 12:51

Mathematics, 29.01.2020 12:51

Mathematics, 29.01.2020 12:51

Mathematics, 29.01.2020 12:51

Physics, 29.01.2020 12:51

Arts, 29.01.2020 12:51