Please help!! equilibrium price

...

Business, 18.10.2021 08:40 athenajames1221

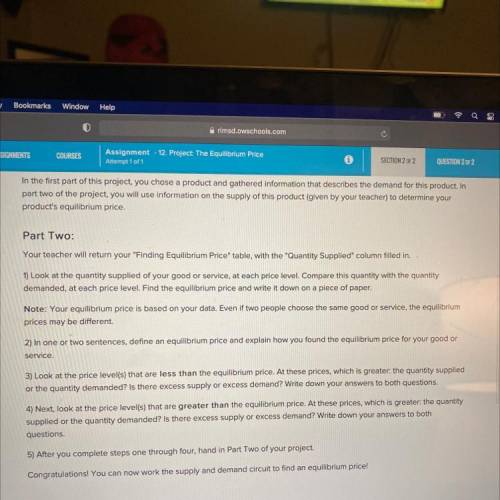

Please help!! equilibrium price

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:10, Emptypockets451

Vulcan flyovers offers scenic overflights of mount st. helens, the volcano in washington state that explosively erupted in 1982. data concerning the company’s operations in july appear below: vulcan flyovers operating data for the month ended july 31 actual results flexible budget planning budget flights (q) 56 56 54 revenue ($350.00q) $ 16,500 $ 19,600 $ 18,900 expenses: wages and salaries ($3,300 + $91.00q) 8,354 8,396 8,214 fuel ($31.00q) 1,904 1,736 1,674 airport fees ($870 + $35.00q) 2,730 2,830 2,760 aircraft depreciation ($11.00q) 616 616 594 office expenses ($240 + $1.00q) 464 296 294 total expense 14,068 13,874 13,536 net operating income $ 2,432 $ 5,726 $ 5,364 the company measures its activity in terms of flights. customers can buy individual tickets for overflights or hire an entire plane for an overflight at a discount. required: 1. prepare a flexible budget performance report for july that includes revenue and spending variances and activity variances.

Answers: 1

Business, 22.06.2019 23:50, christi1175

Jaguar has full manufacturing costs of their s-type sedan of £22,803. they sell the s-type in the uk with a 20% margin for a price of £27,363. today these cars are available in the us for $55,000 which is the uk price multiplied by the current exchange rate of $2.01/£. jaguar has committed to keeping the us price at $55,000 for the next six months. if the uk pound appreciates against the usd to an exchange rate of $2.15/£, and jaguar has not hedged against currency changes, what is the amount the company will receive in pounds at the new exchange rate?

Answers: 1

Business, 23.06.2019 00:00, zhellyyyyy

The gorman group is a financial planning services firm owned and operated by nicole gorman. as of october 31, 2016, the end of the fiscal year, the accountant for the gorman group prepared an end-of-period spreadsheet, part of which follows:

Answers: 2

Business, 23.06.2019 01:00, robert7248

The monthly demand equation for an electric utility company is estimated to be p equals 60 minus left parenthesis 10 superscript negative 5 baseline right parenthesis x, where p is measured in dollars and x is measured in thousands of killowatt-hours. the utility has fixed costs of $3 comma 000 comma 000 per month and variable costs of $32 per 1000 kilowatt-hours of electricity generated, so the cost function is upper c left parenthesis x right parenthesis equals 3 times 10 superscript 6 baseline plus 32 x. (a) find the value of x and the corresponding price for 1000 kilowatt-hours that maximize the utility's profit. (b) suppose that the rising fuel costs increase the utility's variable costs from $32 to $38, so its new cost function is upper c 1 left parenthesis x right parenthesis equals 3 times 10 superscript 6 baseline plus 38 x. should the utility pass all this increase of $6 per thousand kilowatt-hours on to the consumers?

Answers: 2

You know the right answer?

Questions in other subjects:

Chemistry, 09.10.2020 01:01

Mathematics, 09.10.2020 01:01

Health, 09.10.2020 01:01

Mathematics, 09.10.2020 01:01