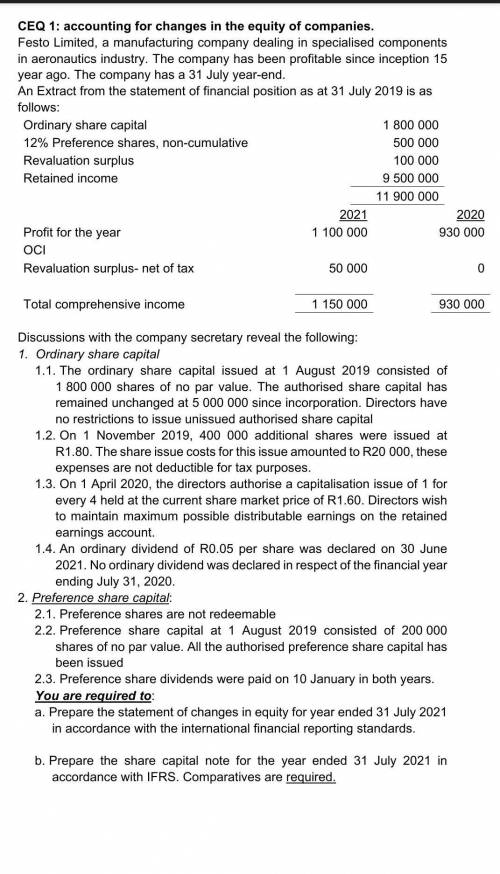

Festo Limited, a manufacturing company dealing in specialised components in aeronautics industry. The company has been profitable since inception 15 year ago. The company has a 31 July year-end. An Extract from the statement of financial position as at 31 July 2019 is as follows: Ordinary share capital 1 800 000 12% Preference shares, non-cumulative 500 000 Revaluation surplus 100 000 Retained income 9 500 000 11 900 000 2021 2020 Profit for the year 1 100 000 930 000 OCI Revaluation surplus- net of tax 50 000 0 Total comprehensive income 1 150 000 930 000 Discussions with the company secretary reveal the following: 1. Ordinary share capital 1.1. The ordinary share capital issued at 1 August 2019 consisted of 1 800 000 shares of no par value. The authorised share capital has remained unchanged at 5 000 000 since incorporation. Directors have no restrictions to issue unissued authorised share capital 1.2. On 1 November 2019, 400 000 additional shares were issued at R1.80. The share issue costs for this issue amounted to R20 000, these expenses are not deductible for tax purposes. 1.3. On 1 April 2020, the directors authorise a capitalisation issue of 1 for every 4 held at the current share market price of R1.60. Directors wish to maintain maximum possible distributable earnings on the retained earnings account. 1.4. An ordinary dividend of R0.05 per share was declared on 30 June 2021. No ordinary dividend was declared in respect of the financial year ending July 31, 2020. 2. Preference share capital: 2.1. Preference shares are not redeemable 2.2. Preference share capital at 1 August 2019 consisted of 200 000 shares of no par value. All the authorised preference share capital has been issued 2.3. Preference share dividends were paid on 10 January in both years. You are required to: a. Prepare the statement of changes in equity for year ended 31 July 2021 in accordance with the international financial reporting standards. b. Prepare the share capital note for the year ended 31 July 2021 in accordance with IFRS. Comparatives are required.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, Studyhard4706

8. agreement and disagreement among economists suppose that bob, an economist from a university in arizona, and cho, an economist from a public television program, are arguing over saving incentives. the following dialogue shows an excerpt from their debate: cho: i think it's safe to say that, in general, the savings rate of households in today's economy is much lower than it really needs to be to sustain an improvement in living standards. bob: i think a switch from the income tax to a consumption tax would bring growth in living standards. cho: you really think households would change their saving behavior enough in response to this to make a difference? because i don't. the disagreement between these economists is most likely due to . despite their differences, with which proposition are two economists chosen at random most likely to agree? rent ceilings reduce the quantity and quality of available housing. immigrants receive more in government benefits than they contribute in taxes. having a single income tax rate would improve economic performance.

Answers: 1

Business, 22.06.2019 12:50, tayjohn9774

Kendrick is leaving his current position at a company, and charlize is taking over. kendrick set up his powerpoint for easy access for himself. charlize needs to work in the program that is easy for her to use. charlize should reset advanced options

Answers: 3

Business, 22.06.2019 18:30, lebronbangs8930

> > objectives define federalism and explain why the framers adopted a federal system instead of a unitary system. categorize powers delegated to and denied to the national government, and powers reserved for and denied to the states, and the difference between exclusive and concurrent powers.

Answers: 1

Business, 22.06.2019 20:20, dd123984

Levine inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. direct materials (9 pounds at $1.80 per pound) $16.20 direct labor (6 hours at $14.00 per hour) $84.00 during the month of april, the company manufactures 270 units and incurs the following actual costs. direct materials purchased and used (2,500 pounds) $5,000 direct labor (1,660 hours) $22,908 compute the total, price, and quantity variances for materials and labor.

Answers: 2

You know the right answer?

Festo Limited, a manufacturing company dealing in specialised components in aeronautics industry. Th...

Questions in other subjects:

Chemistry, 27.09.2019 08:30

History, 27.09.2019 08:30

Mathematics, 27.09.2019 08:30

Mathematics, 27.09.2019 08:30

English, 27.09.2019 08:30

Physics, 27.09.2019 08:30