Business, 12.08.2021 03:10 Corgilover1234

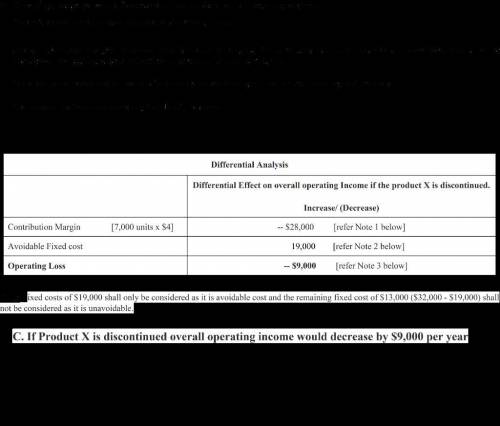

Claris Corporation (a multi-product company) produces and sells 7,000 units of Product X each year. Each unit of Product X sells for $12 and has a contribution margin of $4. If Product X is discontinued, $19,000 of the $32,000 in fixed costs charged to Product X could be eliminated. If Product X is discontinued, the company's overall operating income would:

a. decrease by $4,000 per year.

b. increase by $4,000 per year.

c. decrease by $9,000 per year.

d. increase by $9,000 per year.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 12:50, HarleyQuinn117

Performance bicycle company makes steel and titanium handle bars for bicycles. it requires approximately 1 hour of labor to make one handle bar of either type. during the most recent accounting period, barr company made 7,700 steel bars and 2,300 titanium bars. setup costs amounted to $35,000. one batch of each type of bar was run each month. if a single company-wide overhead rate based on direct labor hours is used to allocate overhead costs to the two products, the amount of setup cost assigned to the steel bars will be:

Answers: 2

Business, 22.06.2019 18:50, jordendoctorwho

)a business incurs the following costs per unit: labor $125/unit, materials $45/unit, and rent $250,000/month. if the firm produces 1,000,000 units a month, calculate the following: a. total variable costs b. total fixed costs c. total costs

Answers: 1

Business, 22.06.2019 19:20, dayday0

Six years ago, an 80-kw diesel electric set cost $160,000. the cost index for this class of equipment six years ago was 187 and is now 194. the cost-capacity factor is 0.6. the plant engineering staff is considering a 120-kw unit of the same general design to power a small isolated plant. assume we want to add a precompressor, which (when isolated and estimated separately) currently costs $13291. determine the total cost of the 120-kw unit. (hint: skip $ and comma symbols)

Answers: 3

Business, 22.06.2019 21:20, isabelvaldez123

Which of the following best describes vertical integration? a. produce goods or services previously purchasedb. develop the ability to produce products that complement the original productc. develop the ability to produce the specified good more efficiently than befored. build long term partnerships with a few supplierse. sell products to a supplier or a distributor

Answers: 2

You know the right answer?

Claris Corporation (a multi-product company) produces and sells 7,000 units of Product X each year....

Questions in other subjects:

Biology, 05.05.2020 17:02

Social Studies, 05.05.2020 17:02

Mathematics, 05.05.2020 17:02

Mathematics, 05.05.2020 17:02

Social Studies, 05.05.2020 17:02