Business, 09.08.2021 01:00 natenate32

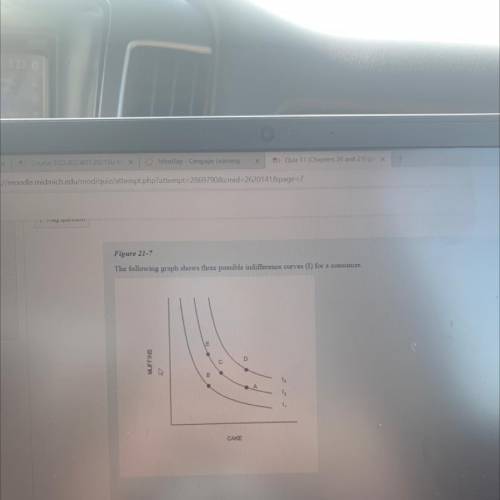

Refer to Figure 21-7. Which

of the following comparisons is correct regarding the marginal rate of substitution (MRS) of muffins for cake?

Select one:

O a. The MRS is greater between bundles C and A than between bundles E and C.

O b. The MRS is greater between bundles D and C than between bundles C and B.

O c. The MRS is the same between bundles E and C and bundles C and A because all three bundles lie on the same indifference curve.

O d. The MRS is greater between bundles E and C than between bundles C and A

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 08:40, raffigi

Which of the following statements is true regarding the reporting of outside interests and the management of conflicts? investigators are responsible for developing their own management plans for significant financial interests. the institution must report identified financial conflicts of interest to the u. s. office of research integrity. investigators must disclose their significant financial interests related to their institutional responsibilities and not just those related to a particular project. investigators must disclose all of their financial interests regardless of whether they are related to a research project.

Answers: 3

Business, 22.06.2019 14:20, deisyy101

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

Business, 22.06.2019 17:40, gabe2111

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 22.06.2019 20:30, BeverlyFarmer

Discuss ways that oracle could provide client customers with the ability to form better relationships with customers.

Answers: 3

You know the right answer?

Refer to Figure 21-7. Which

of the following comparisons is correct regarding the marginal rate of...

Questions in other subjects:

Biology, 05.05.2020 00:52

Mathematics, 05.05.2020 00:52

English, 05.05.2020 00:52

English, 05.05.2020 00:52

Mathematics, 05.05.2020 00:52

History, 05.05.2020 00:52