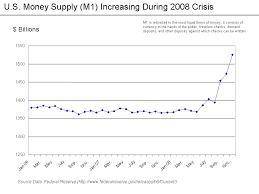

Since October 2008, the Federal Reserve has paid interest on excess reserves held by banks. Under these circumstances, if the Fed buys Treasury securities worth $300 million from a bank, how will the money supply be affected? Assume that the required reserve ratio is 10% and that all currency is deposited into the banking system.

A. The money supply will increase by less than $3 billion,

B. The money supply will increase by $3 billion

C. The money supply will not change at all

D. The money supply will increase by more than $3 billion

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:00, elisakate8362

Which of the following statements is true about financial planning

Answers: 2

Business, 22.06.2019 11:20, tatilynnsoto17

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year. a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs. b. calculate the eoq. c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 13:00, dolltan

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

Business, 22.06.2019 20:00, LJ710

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

You know the right answer?

Since October 2008, the Federal Reserve has paid interest on excess reserves held by banks. Under th...

Questions in other subjects:

Biology, 22.09.2019 10:30

Mathematics, 22.09.2019 10:30

Mathematics, 22.09.2019 10:30

Mathematics, 22.09.2019 10:30

Arts, 22.09.2019 10:30

History, 22.09.2019 10:30

Chemistry, 22.09.2019 10:30