Business, 30.07.2021 04:30 anthonywdjr5211

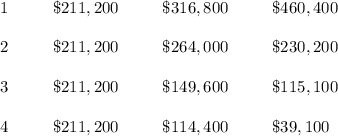

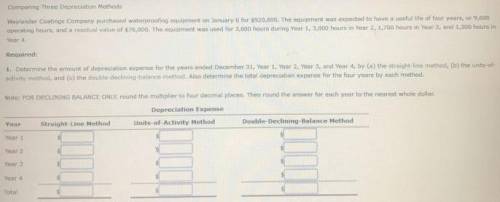

Comparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $502,200. The equipment was expected to have a useful life of four years, or 9,600 operating hours, and a residual value of $41,400. The equipment was used for 3,600 hours during Year 1, 3,000 hours in Year 2, 1,700 hours in Year 3, and 1,300 hours in Year 4.

Required:

Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:30, mobslayer88

Iam trying to get more members on my blog. how do i do this?

Answers: 3

Business, 22.06.2019 11:00, cedricevans41p4j3kx

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 12:40, daphnewibranowsky

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

Business, 22.06.2019 21:30, anthonybowie99

What term is used to describe the outsourcing of logistics? a. shipper managed inventoryb. hollow logistics(smi)c. sub-logisticsd. e-logisticse. third-party logistics (3pl)

Answers: 1

You know the right answer?

Comparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on...

Questions in other subjects:

Mathematics, 13.01.2020 03:31

English, 13.01.2020 03:31

Biology, 13.01.2020 03:31

Chemistry, 13.01.2020 03:31

History, 13.01.2020 03:31

Mathematics, 13.01.2020 03:31

Mathematics, 13.01.2020 03:31