Business, 20.07.2021 01:20 carlosiscr7

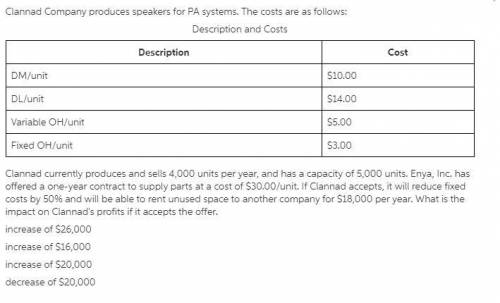

Clannad currently produces and sells 4,000 units per year, and has a capacity of 5,000 units. Enya, Inc. has offered a one-year contract to supply parts at a cost of $30.00/unit. If Clannad accepts, it will reduce fixed costs by 50% and will be able to rent unused space to another company for $18,000 per year. What is the impact on Clannad's profits if it accepts the offer.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 16:00, hunterbetterton1

Straight arrow unloaded two tankers worth of toxic waste at an important port in the country of urithmea. a hundred workers worked two days in their shorts and sandals to unload the barrels from the tankers for $5 a day. they were not told about the content of the barrels. some observers felt that it was the obligation of not just the government of urithmea but also of straight arrow to ensure that no harm was done to the workers. these observers are most likely

Answers: 2

Business, 22.06.2019 01:00, natalie857123

When color is used on a topographical drawing, black is used to represent what?

Answers: 1

Business, 22.06.2019 03:30, jonathanLV6231

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 10:30, kingyogii

The rybczynski theorem describes: (a) how commodity price changes influence real factor rewards (b) how commodity price changes influence relative factor rewards. (c) how changes in factor endowments cause changes in commodity outputs. (d) how trade leads to factor price equalization.

Answers: 1

You know the right answer?

Clannad currently produces and sells 4,000 units per year, and has a capacity of 5,000 units. Enya,...

Questions in other subjects:

Mathematics, 05.03.2020 16:10

Mathematics, 05.03.2020 16:12

Biology, 05.03.2020 16:13