Business, 22.06.2021 01:00 supasavb99

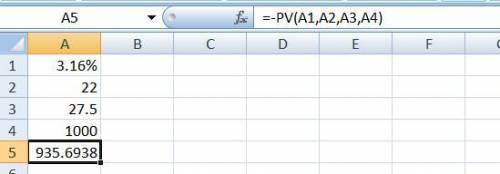

Wine and Roses, Inc. offers a 5.5 percent coupon bond with semiannual payments and a yield to maturity of 6.32 percent. The bonds mature in 11 years. What is the market price of a $1,000 face value bond?a. $1,008.79b. $1,431.32c. $1,504.37d. $935.69e. $1,367.02

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 19:00, Anonymouslizard

All of the following led to the collapse of the soviet economy except a. a lack of worker incentives. c. inadequate supply of consumer goods. b. a reliance on production quotas. d. the introduction of a market economy.

Answers: 1

Business, 22.06.2019 19:30, ssiy

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 22.06.2019 20:10, hsbhxsb

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

You know the right answer?

Wine and Roses, Inc. offers a 5.5 percent coupon bond with semiannual payments and a yield to maturi...

Questions in other subjects:

Mathematics, 02.04.2021 16:10

Social Studies, 02.04.2021 16:10

Physics, 02.04.2021 16:10

Mathematics, 02.04.2021 16:10

English, 02.04.2021 16:10

Mathematics, 02.04.2021 16:10