Business, 11.06.2021 14:00 debbieparr4536

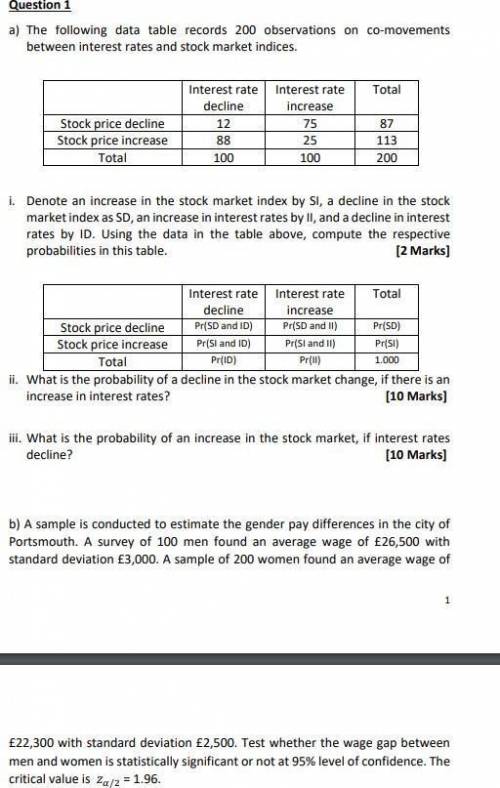

Question 1 a) The following data table records 200 observations on co-movements between interest rates and stock market indices. Total Interest rate decline 12 88 Stock price decline Stock price increase Interest rate increase 75 25 100 87 113 200 Total 100 i. Denote an increase in the stock market index by SI, a decline in the stock market index as SD, an increase in interest rates by II, and a decline in interest rates by ID. Using the data in the table above, compute the respective probabilities in this table. [2 marks] Interest rate Interest rate Total decline increase Stock price decline Pr(SD and ID) Pr(SD and 11) Pr(SD) Stock price increase Pr(Si and ID) Pr(SI and II) Pr(SI) Total Pr(ID) Pr(1) ii. What is the probability of a decline in the stock market change, if there is an increase in interest rates? (10 Marks) 1.000 iii. What is the probability of an increase in the stock market, if interest rates decline? [10 Marks] b) A sample is conducted to estimate the gender pay differences in the city of Portsmouth. A survey of 100 men found an average wage of £26,500 with standard deviation £3,000. A sample of 200 women found an average wage of 1 £22,300 with standard deviation £2,500. Test whether the wage gap between men and women is statistically significant or not at 95% level of confidence. The critical value is 2a/2 = 1.96.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:30, divagothboi

How does your household gain from specialization and comparative advantage? (what is produced, what is not produced yet paid to a specialist to produce? )

Answers: 3

Business, 22.06.2019 06:30, brony2199

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n. v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

Business, 22.06.2019 09:40, cerna

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

You know the right answer?

Question 1 a) The following data table records 200 observations on co-movements between interest rat...

Questions in other subjects:

Mathematics, 08.07.2019 17:30

Mathematics, 08.07.2019 17:30

Mathematics, 08.07.2019 17:30