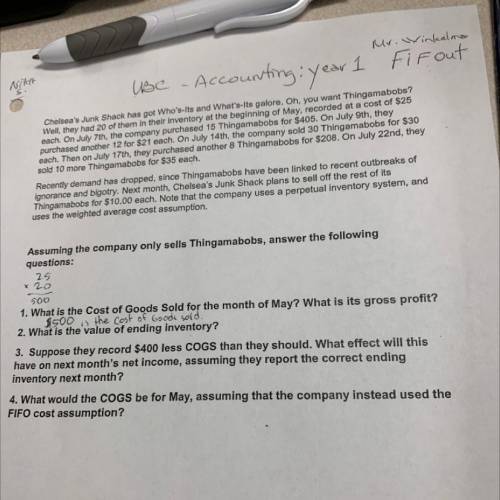

Chelsea's Junk Shack has got Who's-Its and What's-Its galore. Oh, you want Thingamabobs?

Well, they had 20 of them in their inventory at the beginning of May, recorded at a cost of $25

each. On July 7th, the company purchased 15 Thingamabobs for $405. On July 9th, they

purchased another 12 for $21 each. On July 14th, the company sold 30 Thingamabobs for $30

each. Then on July 17th, they purchased another 8 Thingamabobs for $208. On July 22nd, they

sold 10 more Thingamabobs for $35 each.

Recently demand has dropped, since Thingamabobs have been linked to recent outbreaks of

ignorance and bigotry. Next month, Chelsea's Junk Shack plans to sell off the rest of its

Thingamabobs for $10.00 each. Note that the company uses a perpetual inventory system, and

uses the weighted average cost assumption.

Assuming the company only sells Thingamabobs, answer the following

questions:

25

x 20

900

1. What is the Cost of Goods Sold for the month of May? What is its gross profit?

asoom the conoscono

2. What is the value of ending inventory?

3. Suppose they record $400 less COGS than they should. What effect will this

have on next month's net income, assuming they report the correct ending

inventory next month?

4. What would the COGS be for May, assuming that the company instead used the

FIFO cost assumption?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:30, issaaamiaaa15

Needs to schedule the staffing of the center. it is open from 8am until midnight. larry has monitored the usage of the center at various times of the day and determined that the following number of computer consultants are required: time of dayminimum number of consultants required to be on duty8 am-noon4noon-4 pm84pm-8pm108pm-midnight6 two types of computer consultants can be hired: full-time and part-time. the full- time consultants work for eight consecutive hours in any of the shifts: morning (8am- 4pm), afternoon (noon-8pm) and evening (4pm-midnight). full-time consultants are paid $14 per hour. part-time consultants can be hired to work any of the four shifts listed in the table. part-time consultants are paid $12 per hour. an additional requirement is that during every time period, there must be at least two full-time consultants on duty for every part-time consultant on duty. larry would like to determine how many full-time and part-time consultants should work each shift to meet the above requirements at the minimum possible cost. formulate this as an lp problem. you must define your variables clearly

Answers: 2

Business, 22.06.2019 09:40, ameliaduxha7

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 21:40, andyboehm7411

The following items could appear on a bank reconciliation: a. outstanding checks, $670. b. deposits in transit, $1,500. c. nsf check from customer, no. 548, for $175. d. bank collection of note receivable of $800, and interest of $80. e. interest earned on bank balance, $20. f. service charge, $10. g. the business credited cash for $200. the correct amount was $2,000. h. the bank incorrectly decreased the business's by $350 for a check written by another business. classify each item as (1) an addition to the book balance, (2) a subtraction from the book balance, (3) an addition to the bank balance, or (4) a subtraction from the bank balance.

Answers: 1

Business, 22.06.2019 22:40, shunna33

Colorado rocky cookie company offers credit terms to its customers. at the end of 2018, accounts receivable totaled $715,000. the allowance method is used to account for uncollectible accounts. the allowance for uncollectible accounts had a credit balance of $50,000 at the beginning of 2018 and $30,000 in receivables were written off during the year as uncollectible. also, $3,000 in cash was received in december from a customer whose account previously had been written off. the company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year. 1. prepare journal entries to record the write-off of receivables, the collection of $3,000 for previously written off receivables, and the year-end adjusting entry for bad debt expense.2. how would accounts receivable be shown in the 2018 year-end balance sheet?

Answers: 1

You know the right answer?

Chelsea's Junk Shack has got Who's-Its and What's-Its galore. Oh, you want Thingamabobs?

Well, they...

Questions in other subjects:

Mathematics, 29.04.2021 04:00