Business, 24.05.2021 17:20 scottmichetti

Easton Corporation is involved in the evaluation of a new computer-integrated manufacturing system. The system has a projected initial cost of $1,000,000. It has an expected life of six years, with no salvage value, and is expected to generate annual cost savings of $250,000. Based on Easton Corporation's analysis, the project has a net present value of $57,625.

1. Refer to Rhodes Corporation. What discount rate did the company use to compute the net present value? Present value tables or a financial calculator are required.

a. 10 %

b. 11 %

c. 12 %

d. 13 %

2. Refer to Rhodes Corporation. What is the project's profitability index?

a. 1.058

b. .058

c. .945

d. 1.000

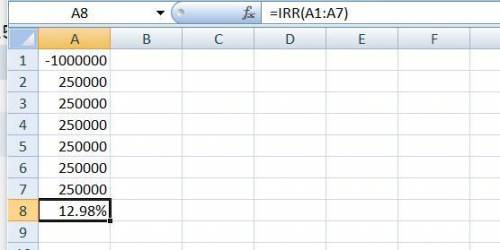

3. Refer to Rhodes Corporation. What is the project's internal rate of return? Present value tables or a financial calculator are required.

a. between 12.5 and 13.0 percent

b. between 11.0 and 11.5 percent

c. between 11.5 and 12.0 percent

d. between 13.0 and 13.5 percent

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 18:20, jrjordans13ox06qs

When someone buys a fourth television for his or her house, what is the result? a. there's a decrease in the marginal utility of the television. b. the increase in demand brings leads to higher prices for televisions. c. the production of televisions becomes more efficient. d. there's a rise in the opportunity cost of buying other goods.

Answers: 2

Business, 21.06.2019 20:30, christinachavez081

The federal act which provided over $7 billion to the epa to protect and promote "green" jobs and a healthier environment is the - national environmental policy act. - resource recovery act.- resource conservation and recovery act.- american recovery and reinvestment act. - clean air act.

Answers: 1

Business, 21.06.2019 21:00, janiyaf8941

The following cost data relate to the manufacturing activities of chang company during the just completed year: manufacturing overhead costs incurred: indirect materials $ 15,800 indirect labor 138,000 property taxes, factory 8,800 utilities, factory 78,000 depreciation, factory 150,600 insurance, factory 10,800 total actual manufacturing overhead costs incurred $ 402,000 other costs incurred: purchases of raw materials (both direct and indirect) $ 408,000 direct labor cost $ 68,000 inventories: raw materials, beginning $ 20,800 raw materials, ending $ 30,800 work in process, beginning $ 40,800 work in process, ending $ 70,800 the company uses a predetermined overhead rate of $20 per machine-hour to apply overhead cost to jobs. a total of 20,500 machine-hours were used during the year. required: 1. compute the amount of underapplied or overapplied overhead cost for the year. 2. prepare a schedule of cost of goods manufactured for the year.

Answers: 3

Business, 22.06.2019 05:00, grangian06

Personal financial planning is the process of creating and achieving financial goals? true or false

Answers: 1

You know the right answer?

Easton Corporation is involved in the evaluation of a new computer-integrated manufacturing system....

Questions in other subjects:

Biology, 16.07.2021 04:40

English, 16.07.2021 04:40