Business, 23.04.2021 16:10 pum9roseslump

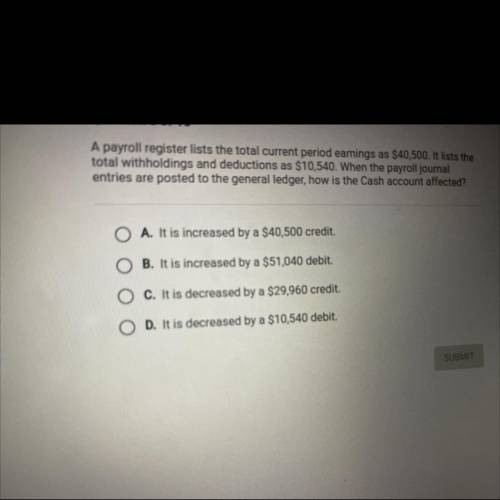

A payroll register lists the total current period earnings as $40,500. It lists the

total withholdings and deductions as $10,540. When the payroll journal

entries are posted to the general ledger, how is the Cash account affected?

O A. It is increased by a $40,500 credit.

B. It is increased by a $51,040 debit.

C. It is decreased by a $29,960 credit.

O D. It is decreased by a $10,540 debit.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:30, Mikec123

Select the correct answer. joshua runs a large manufacturing business that is listed on the stock exchange. his company made good profits in the previous financial year. he now plans to reward his shareholders with handsome dividends. under which category of activities in the cash flow statement would the company’s accountants place this outflow of cash? a. investing activities b. operating activities c. financing activities d. non-operating activities

Answers: 3

Business, 22.06.2019 05:30, tommyaberman

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 06:30, solphiafischer

Individual consumers belong to which step of choosing a target market? possible customers competition demographics communication

Answers: 2

Business, 22.06.2019 07:10, Pipemacias1711

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u. s. parent on bank deposits held in london d. interest received by a u. s. parent on a loan to a subsidiary in mexico e. principal repayment received by u. s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u. s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

You know the right answer?

A payroll register lists the total current period earnings as $40,500. It lists the

total withhold...

Questions in other subjects:

Mathematics, 13.02.2020 05:33

History, 13.02.2020 05:33

Mathematics, 13.02.2020 05:34