Business, 21.04.2021 14:00 Peterson6164

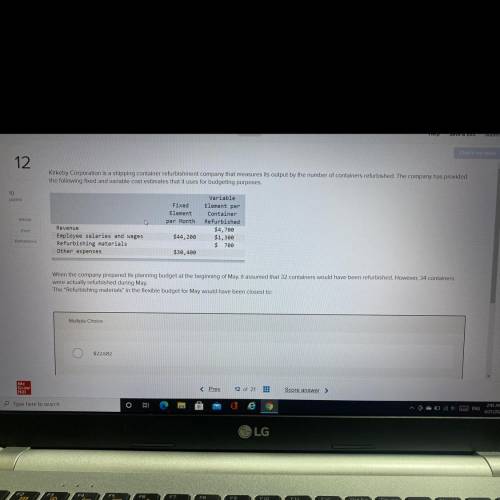

Kirkeby Corporation is a shipping container refurbishment company that measures its output by the number of containers refurbished. The company has provided

the following fixed and variable cost estimates that it uses for budgeting purposes.

Variable

Fixed Element per

Element Container

per Month Refurbished

$4,700

$44,200 $1,300

$ 700

$30,400

Revenue

Employee salaries and wages

Refurbishing materials

Other expenses

When the company prepared its planning budget at the beginning of May, it assumed that 32 containers would have been refurbished. However, 34 containers

were actually refurbished during May

The "Refurbishing materials in the flexible budget for May would have been closest to:

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:00, kluckey3426

Which statement is true of both presidential and parliamentary systems of government? a. the executive branch operates independently from the legislative branch. b. the members of the legislative branch are directly elected by the people. c. the head of government is chosen by members of his or her political party. d. the head of government is directly elected by the people

Answers: 1

Business, 22.06.2019 10:50, hsjsjsjdjjd

Suppose that a firm is considering moving from a batch process to an assembly-line process to better meet evolving market needs. what concerns might the following functions have about this proposed process change: marketing, finance, human resources, accounting, and information systems?

Answers: 2

Business, 22.06.2019 11:10, amunson40

The green fiddle has declared a $5 per share dividend. suppose capital gains are not taxed, but dividends are taxed at 15 percent. new irs regulations require that taxes be withheld at the time the dividend is paid. green fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. what will the ex-dividend price be?

Answers: 2

Business, 22.06.2019 12:10, ghari112345

In year 1, the bennetts' 25-year-old daughter, jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. in previous years, jane has never worked and her parents have always been able to claim her as a dependent. in year 1, a kind neighbor offers to pay for all of jane's educational and living expenses. which of the following statements is most accurate regarding whether jane's parents would be allowed to claim an exemption for jane in year 1 assuming the neighbor pays for all of jane's support? a. no, jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative. b.yes, because she is a full-time student and does not provide more than half of her own support, jane is considered her parent's qualifying child. c.no, jane is too old to be considered a qualifying child and fails the support test of a qualifying relative. d.yes, because she is a student, her absence is considered as "temporary." consequently she meets the residence test and is a considered a qualifying child of the bennetts.

Answers: 2

You know the right answer?

Kirkeby Corporation is a shipping container refurbishment company that measures its output by the nu...

Questions in other subjects:

Mathematics, 15.04.2021 20:00

Mathematics, 15.04.2021 20:00

Mathematics, 15.04.2021 20:00

History, 15.04.2021 20:00