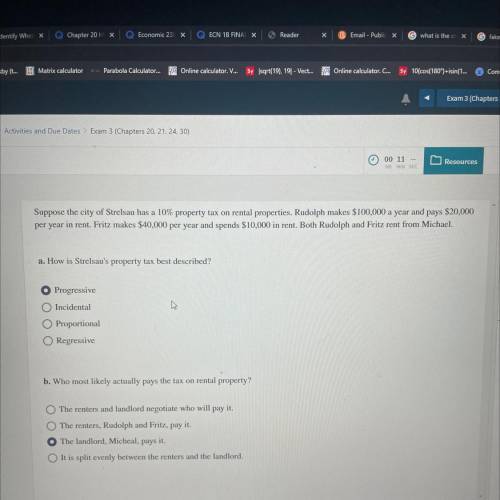

Who most likely actually pays the tax on rental property?

...

Business, 19.04.2021 02:30 jaylan11brown

Who most likely actually pays the tax on rental property?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:40, ayoismeisjjjjuan

Alocation analysis has been narrowed down to two locations, akron and boston. the main factors in the decision will be the supply of raw materials, which has a weight of .50, transportation cost, which has a weight of .40, and labor cost, which has a weight of .10. the scores for raw materials, transportation, and labor are for akron 60, 80, and 70, respectively; for boston 70, 50, and 90, respectively. given this information and a minimum acceptable composite score of 75, we can say that the manager should:

Answers: 3

Business, 21.06.2019 22:40, gobertbrianna40

Job a3b was ordered by a customer on september 25. during the month of september, jaycee corporation requisitioned $2,400 of direct materials and used $3,900 of direct labor. the job was not finished by the end of the month, but needed an additional $2,900 of direct materials in october and additional direct labor of $6,400 to finish the job. the company applies overhead at the end of each month at a rate of 100% of the direct labor cost. what is the amount of job costs added to work in process inventory during october?

Answers: 3

Business, 22.06.2019 14:00, gcristhian8863

Which of the following would be an accurate statement about achieving a balanced budget

Answers: 1

Business, 22.06.2019 14:50, 2020EIglesias180

Pederson company reported the following: manufacturing costs $480,000 units manufactured 8,000 units sold 7,500 units sold for $90 per unit beginning inventory 2,000 units what is the average manufacturing cost per unit? (round the answer to the nearest dollar.)

Answers: 3

You know the right answer?

Questions in other subjects:

History, 09.11.2019 10:31

Biology, 09.11.2019 10:31

Mathematics, 09.11.2019 10:31

Mathematics, 09.11.2019 10:31