Match each type of tax with an example of its use.

1. Income tax

2. Sin tax

3. Excise tax...

Business, 05.04.2021 03:10 ashleybaber4966

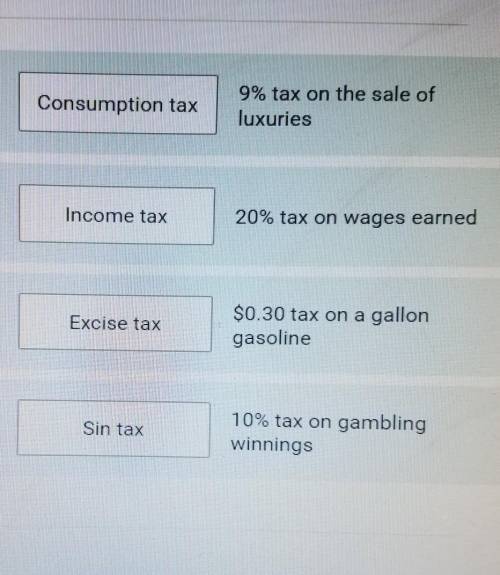

Match each type of tax with an example of its use.

1. Income tax

2. Sin tax

3. Excise tax

4. Consumption tax

A. 9% tax on the sale of luxuries

B. 20% tax on wages earned

C. $0.30 tax on a gallon gasoline

D. 10% tax on gambling winnings

Edit: Correct answers are in the picture

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 21:10, izzy201995

Your family business uses a secret recipe to produce salsa and distributes it through both smaller specialty stores and chain supermarkets. the chain supermarkets have been demanding sizable discounts, but you do not want to drop your prices to the specialty stores. true or false: the robinson-patman act limits your ability to offer discounts to the chain supermarkets while leaving the price high for the smaller stores. true false

Answers: 3

Business, 22.06.2019 21:30, robert7248

Consider the following three bond quotes; a treasury note quoted at 87.25, and a corporate bond quoted at 102.42, and a municipal bond quoted at 101.45. if the treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? multiple choice $872.50, $1,000, $1,000, respectively $1,000, $1,024.20, $1,001.45, respectively $872.50, $1,024.20, $5,072.50, respectively $1,000, $1,000, $1,000, respectively

Answers: 3

Business, 23.06.2019 15:00, rowandohnalek

Value economics capital scarcity opportunity cost wealth labor trade-offs standard of living good a. condition of not having enough resources to produce all the things people want b. alternative choices made by consumers in the marketplace c. sum of those economic products that are tangible, scarce, useful, and transferable d. tools, equipment, machinery, and factories used in the production of goods and services e. tangible item that is economically useful or that satisfies an economic want f. quality of life based on the ownership of the necessities and luxuries that make life easier g. people with all their efforts, abilities, and skills h. cost of the next-best alternative use of money, time, or resources when one choice is made rather than another i. study of how people try to satisfy their needs through the careful use of scarce resources j. worth that can be expressed in dollars and cents

Answers: 1

You know the right answer?

Questions in other subjects:

History, 05.12.2021 15:30

English, 05.12.2021 15:30

Social Studies, 05.12.2021 15:30

English, 05.12.2021 15:30

Mathematics, 05.12.2021 15:30