Business, 02.04.2021 03:20 jacobdesalvo8155

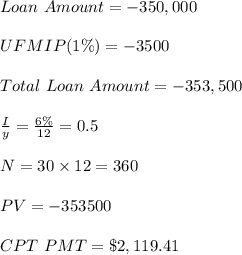

Suppose you are interested in taking an FHA mortgage loan for $350,000 in order to purchase your principal residence. In order to do so, you must pay an additional up-front mortgage insurance premium (UFMIP) of 1.0% of the mortgage balance. If the interest rate on the fully amortizing mortgage loan is 6% and the term is 30 years and the UFMIP is financed (i. e., it is included in the loan amount), what is the dollar portion of your monthly mortgage payment that is designated to cover the UFMIP

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:30, maddielr17

Acompany using the perpetual inventory system purchased inventory worth $540,000 on account with credit terms of 2/15, n/45. defective inventory of $40,000 was returned 2 days later, and the accounts were appropriately adjusted. if the company paid the invoice 20 days later, the journal entry to record the payment would be

Answers: 1

Business, 22.06.2019 10:00, tiarafaimealelei

The solution set for -18 < 5x-3 iso-3х3< xо-3хo3 > x

Answers: 3

Business, 22.06.2019 15:30, graciemccain

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Business, 22.06.2019 16:00, knownperson233

In macroeconomics, to study the aggregate means to study blank

Answers: 1

You know the right answer?

Suppose you are interested in taking an FHA mortgage loan for $350,000 in order to purchase your pri...

Questions in other subjects:

French, 30.12.2020 05:30

Mathematics, 30.12.2020 05:30

Mathematics, 30.12.2020 05:30