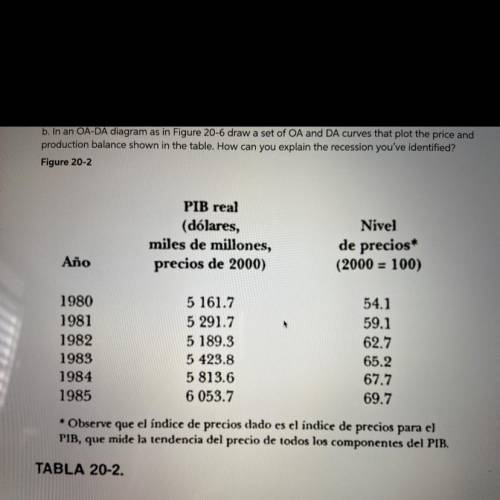

The last phase of contraction in the United States occurred in the early 1980s. Take the real GDP and inflation rate data presented in Table 20-2.

A. Calculate the inflation rate and the real GDP growth rate from 1981 to 1985. Can you determine in which year there was a deep phase of contraction or recession in the economy?

B. In an OA-DA diagram as in figure 20-6 draw a set of OA and DA curves that plot the price and production balance show in the table. How can you explain the recession you’ve identified?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:20, ellycleland16

Which of the following best explains why large companies have an advantage over smaller companies? a. economies of scale make it possible to offer lower prices. b. the production possibilities frontier is wider for a larger company. c. decreasing marginal utility enables more efficient production. d. increasing the scale of production leads to a reduction in inputs.2b2t

Answers: 1

Business, 22.06.2019 07:50, ShawnSaviro4918

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

Business, 22.06.2019 10:30, natajaeecarr

Jack manufacturing company had beginning work in process inventory of $8,000. during the period, jack transferred $34,000 of raw materials to work in process. labor costs amounted to $41,000 and overhead amounted to $36,000. if the ending balance in work in process inventory was $12,000, what was the amount transferred to finished goods inventory?

Answers: 2

You know the right answer?

The last phase of contraction in the United States occurred in the early 1980s. Take the real GDP an...

Questions in other subjects:

Advanced Placement (AP), 15.06.2020 18:57

English, 15.06.2020 18:57

English, 15.06.2020 18:57

History, 15.06.2020 18:57

English, 15.06.2020 18:57

Mathematics, 15.06.2020 18:57

Mathematics, 15.06.2020 18:57

Social Studies, 15.06.2020 18:57

Mathematics, 15.06.2020 18:57