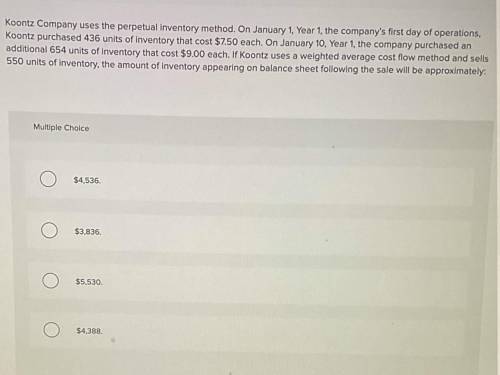

Photo attached Koontz Company uses the perpetual inventory method. On January 1, Year 1, the company's first day of operations,

Koontz purchased 436 units of inventory that cost $7.50 each. On January 10, Year 1, the company purchased an

additional 654 units of inventory that cost $9.00 each. If Koontz uses a weighted average cost flow method and sells

550 units of inventory, the amount of inventory appearing on balance sheet following the sale will be approximately:

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, PerfectMagZ

Abond is issued for less than its face value. which statement most likely would explain why? a. the bond's contract rate is higher than the market rate at the time of the issue. b. the bond's contract rate is the same as the market rate at the time of the issue. c. the bond's contract rate is lower than the market rate at the time of the issue. d. the bond isn't secured by specific assets of the corporation.

Answers: 1

Business, 22.06.2019 20:30, tilly40oooo

This problem has been solved! see the answercompute and interpret altman's z-scoresfollowing is selected financial information for ebay, for its fiscal years 2005 and 2006.(in millions, except per share data) 2006 2005current assets $ 4,970.59 $ 3,183.24current liabilities 2,518.39 1,484.93total assets 13,494.01 11,788.99total liabilities 2,589.38 1,741.00shares outstanding 1,368.51 1,404.18retained earnings 4,538.35 2,819.64stock price per share 30.07 43.22sales 5,969.74 4,552.40earnings before interest and taxes 1,439.77 1,445.18compute and interpret altman z-scores for the company for both years. (do not round until your final answer; then round your answers to two decimal places.)2006 z-score = answer2005 z-score = answerwhich of the following best describes the company's likelihood to go bankrupt given the z-score in 2006 compared to 2007.the z-score in 2006 is half of the 2005 score. both z-scores are well above the score that represents a healthy company. the z-score in 2006 is double the 2005 score. the z-score has increased sharply, which suggests the company has greatly increased the risk of bankruptcy. the z-score in 2006 is half of the 2005 score. the z-score has decreased sharply, which suggests the company is in financial distress. the z-score in 2006 is double the 2005 score. the z-score has increased sharply, which suggests the company has greatly lowered the risk of bankruptcy.

Answers: 3

Business, 23.06.2019 23:00, dogwisperer101

Bella can produce either a combination of 60 silk roses and 80 silk leaves or a combination of 70 silk roses and 55 silk leaves. if she now produces 60 silk roses and 80 silk leaves, what is the opportunity cost of producing an additional 10 silk roses?

Answers: 2

You know the right answer?

Photo attached Koontz Company uses the perpetual inventory method. On January 1, Year 1, the company...

Questions in other subjects:

Mathematics, 23.04.2020 08:42

English, 23.04.2020 08:43

Mathematics, 23.04.2020 08:43

Mathematics, 23.04.2020 08:43