Business, 24.03.2021 17:00 sierram298

For the coming year, Cleves Company anticipates a unit selling price of $100, a unit variable cost of $60, and fixed costs of $480,000.

Required:

1. Compute the anticipated break-even sales in units.

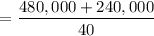

2. Compute the sales (units) required to realize a target profit of $240,000.

3. Construct a cost-volume-profit chart, assuming maximum sales of 20,000 units within the relevant range. From your chart, indicate whether each of the following sales levels would produce a profit, a loss, or break-even.

$1,200,000 SelectBreak-evenLossProfitItem 3

$1,000,000 SelectBreak-evenLossProfitItem 4

$800,000 SelectBreak-evenLossProfitItem 5

$400,000 SelectBreak-evenLossProfitItem 6

$200,000 SelectBreak-evenLossProfitItem 7

4. Determine the probable income (loss) from operations if sales total 16,000 units.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:10, addsd

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 19:40, cieloromero1

Moody corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. at the beginning of the year, the company made the following estimates: machine-hours required to support estimated production 100,000 fixed manufacturing overhead cost $ 650,000 variable manufacturing overhead cost per machine-hour $ 3.00 required: 1. compute the plantwide predetermined overhead rate. 2. during the year, job 400 was started and completed. the following information was available with respect to this job: direct materials $ 450 direct labor cost $ 210 machine-hours used 40

Answers: 3

Business, 22.06.2019 23:00, kobiemajak

Doogan corporation makes a product with the following standard costs: standard quantity or hours standard price or rate direct materials 2.0 grams $ 7.00 per gram direct labor 1.6 hours $ 12.00 per hour variable overhead 1.6 hours $ 6.00 per hour the company produced 5,000 units in january using 10,340 grams of direct material and 2,320 direct labor-hours. during the month, the company purchased 10,910 grams of the direct material at $7.30 per gram. the actual direct labor rate was $12.85 per hour and the actual variable overhead rate was $5.80 per hour. the company applies variable overhead on the basis of direct labor-hours. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for january is:

Answers: 1

Business, 23.06.2019 01:30, upadrastakameswari

You need $87,000 in 12 years. required: if you can earn .54 percent per month, how much will you have to deposit today?

Answers: 2

You know the right answer?

For the coming year, Cleves Company anticipates a unit selling price of $100, a unit variable cost o...

Questions in other subjects:

World Languages, 08.12.2021 21:30

English, 08.12.2021 21:30

Social Studies, 08.12.2021 21:30

Business, 08.12.2021 21:30

Mathematics, 08.12.2021 21:30