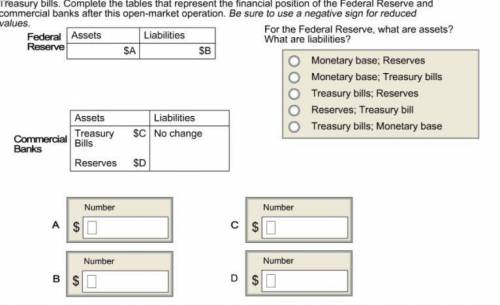

Suppose that the Federal Reserve decides to decrease the money supply with a $300 purchases of Treasury bills. Complete the tables that represent the financial position of the Federal Reserve and commercial banks after this open-market operation. Be sure to use a negative sign for reduced values.

Federal Reserves Assest Liabilities

Commercial Reserves Assets Liabilities

For the Federal Reserve, what are assets? What are liabilities?

a. Monetary base; Reserves

b. Monetary base; Treasury bills

c. Treasury bills; Reserves

d. Reserves; Treasury bill

e. Treasury bills; Monetary base

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:10, SmokeyRN

Kando company incurs a $9 per unit cost for product a, which it currently manufactures and sells for $13.50 per unit. instead of manufacturing and selling this product, the company can purchase product b for $5 per unit and sell it for $12 per unit. if it does so, unit sales would remain unchanged and $5 of the $9 per unit costs assigned to product a would be eliminated. 1. prepare incremental cost analysis. should the company continue to manufacture product a or purchase product b for resale? (round your answers to 2 decimal places.)

Answers: 1

Business, 22.06.2019 01:20, 15krystall

Cindy recently played in a softball game in which she misplayed a ground ball for an error. later, in the same game, she made a great catch on a very difficult play. according to the self-serving bias, she would attribute her error to and her good catch to her

Answers: 1

Business, 22.06.2019 03:30, jadahilbun01

Instructions: use the following information to construct the 2000 balance sheet and income statement for carolina business machines. round all numbers to the nearest whole dollar. all numbers are in thousands of dollars. be sure to read the whole problem before you jump in and get started. at the end of 1999 the firm had $43,000 in gross fixed assets. in 2000 they purchased an additional $14,000 of fixed asset equipment. accumulated depreciation at the end of 1999 was $21,000. the depreciation expense in 2000 is $4,620. at the end of 2000 the firm had $3,000 in cash and $3,000 in accounts payable. in 2000 the firm extended a total of $9,000 in credit to a number of their customers in the form of accounts receivable. the firm generated $60,000 in sales revenue in 2000. their cost of goods sold was 60 percent of sales. they also incurred salaries and wages expense of $10,000. to date the firm has $1,000 in accrued salaries and wages. they borrowed $10,000 from their local bank to finance the $15,000 in inventory they now have on hand. the firm also has $7,120 invested in marketable securities. the firm currently has $20,000 in long-term debt outstanding and paid $2,000 in interest on their outstanding debt. over the firm's life, shareholders have put up $30,000. eighty percent of the shareholder's funds are in the form of retained earnings. the par value per share of carolina business machines stock is

Answers: 3

Business, 22.06.2019 11:40, sabrinabowers4308

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

You know the right answer?

Suppose that the Federal Reserve decides to decrease the money supply with a $300 purchases of Treas...

Questions in other subjects:

Chemistry, 14.11.2019 07:31

Engineering, 14.11.2019 07:31

Mathematics, 14.11.2019 07:31

Engineering, 14.11.2019 07:31