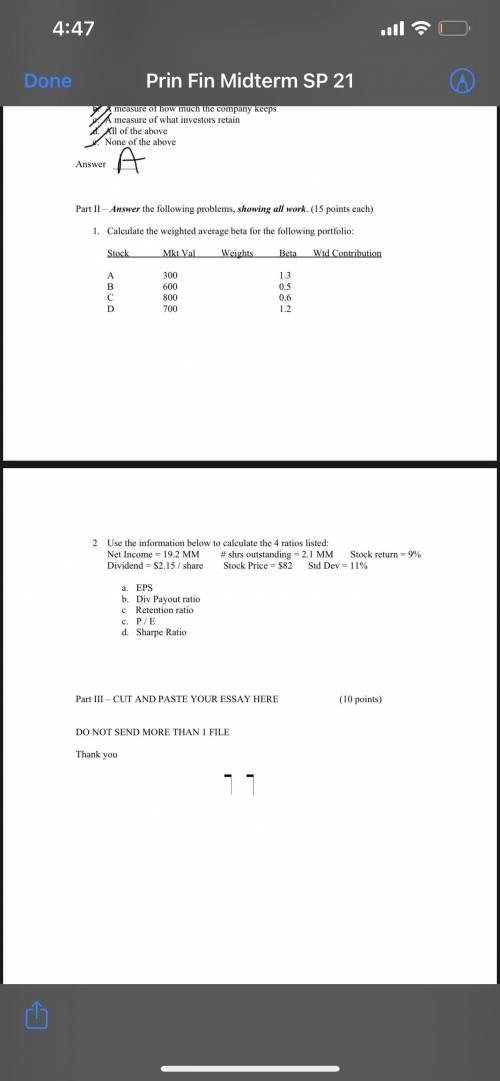

Calculate the weighted average beta for the following portfolio:

Stock Mkt Val

A 300

B...

Business, 18.03.2021 02:00 quinnmal023

Calculate the weighted average beta for the following portfolio:

Stock Mkt Val

A 300

B 600

C 800

D 700

Weights

Beta Wtd Contribution

1.3 0.5 0.6 1.2

2 Use the information below to calculate the 4 ratios listed:

Net Income = 19.2 MM Dividend = $2.15 / share

a. EPS

b. Div Payout ratio c Retention ratio c. P/E

d. Sharpe Ratio

# shrs outstanding = 2.1 MM Stock return = 9%

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 15:30, jasonoliva13

Careers in designing, planning, managing, building and maintaining the built environment can be found in the following career cluster: a. agriculture, food & natural resources b. architecture & construction c. arts, audio-video technology & communications d. business, management & administration

Answers: 2

Business, 22.06.2019 17:20, sctenk6052

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 22.06.2019 17:20, shakira11harvey6

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 22.06.2019 19:00, bussbhsvssu557

The market demand curve for a popular teen magazine is given by q = 80 - 10p where p is the magazine price in dollars per issue and q is the weekly magazine circulation in units of 10,000. if the circulation is 400,000 per week at the current price, what is the consumer surplus for a teen reader with maximum willingness to pay of $3 per issue?

Answers: 1

You know the right answer?

Questions in other subjects:

Mathematics, 26.03.2021 06:00

Chemistry, 26.03.2021 06:00

French, 26.03.2021 06:00

Mathematics, 26.03.2021 06:00

Social Studies, 26.03.2021 06:00