Business, 18.03.2021 01:20 sophiamoser

In the linear consumption function

cons = ^B0 + ^B1 * inc

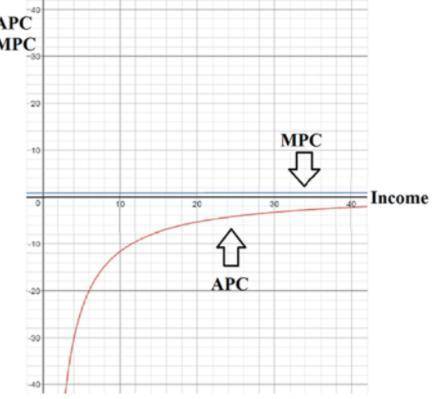

the (estimated) marginal propensity to consume (MPC) out of income is simply the slope,

^B1,

, while the average propensity to consume (APC) is ^cons/inc = ^B0 /inc + ^B1

. Using obser-

vations for 100 families on annual income and consumption (both measured in dollars), the

following equation is obtained:

^cons = -124.84 + .853 * inc

n=100, R^2 = .692

(i) Interpret the intercept in this equation, and comment on its sign and magnitude.

(ii) What is the predicted consumption when family income is $30,000?

(iii) With inc on the x-axis, draw a graph of the estimated MPC and APC.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 14:20, nataliaalejandradasi

Jaynet spends $50,000 per year on painting supplies and storage space. she recently received two job offers from a famous marketing firm – one offer was for $95,000 per year, and the other was for $120,000. however, she turned both jobs down to continue a painting career. if jaynet sells 35 paintings per year at a price of $6,000 each: a. what are her accounting profits? b. what are her economic profits?

Answers: 1

Business, 22.06.2019 19:40, mahoganyking16

Chang corp. has $375,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $595,000, and its net income was $25,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. what profit margin would the firm need in order to achieve the 15% roe, holding everything else constant? a. 9.45%b. 9.93%c. 10.42%d. 10.94%e. 11.49%

Answers: 2

Business, 22.06.2019 19:50, lucky1940

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

Business, 22.06.2019 20:30, ilovevegene

Blue computers, a major pc manufacturer in the united states, currently has plants in kentucky and pennsylvania. the kentucky plant has a capacity of 1 million units a year and the pennsylvania plant has a capacity of 1.5 million units a year. the firm divides the united states into five markets: northeast, southeast, midwest, south, and west. each pc sells for $1,000. the firm anticipates a 50 perc~nt growth in demand (in each region) this year (after which demand will stabilize) and wants to build a plant with a capacity of 1.5 million units per year to accommodate the growth. potential sites being considered are in north carolina and california. currently the firm pays federal, state, and local taxes on the income from each plant. federal taxes are 20 percent of income, and all state and local taxes are 7 percent of income in each state. north carolina has offered to reduce taxes for the next 10 years from 7 percent to 2 percent. blue computers would like to take the tax break into consideration when planning its network. consider income over the next 10 years in your analysis. assume that all costs remain unchanged over the 10 years. use a discount factor of 0.1 for your analysis. annual fixed costs, production and shipping costs per unit, and current regional demand (before the 50 percent growth) are shown in table 5-13. (a) if blue computers sets an objective of minimizing total fixed and variable costs, where should they build the new plant? how should the network be structured? (b) if blue computers sets an objective of maximizing after-tax profits, where should they build the new plant? how should the network be structured? variable production and shipping cost ($/unit) annual fixed cost northeast southeast midwest south west (million$) kentucky 185 180 175 175 200 150 pennsylvania 170 190 180 200 220 200 n. carolina 180 180 185 185 215 150 california 220 220 195 195 175 150 demand ('000 units/month) 700 400 400 300 600

Answers: 3

You know the right answer?

In the linear consumption function

cons = ^B0 + ^B1 * inc

the (estimated) marginal propensity...

the (estimated) marginal propensity...

Questions in other subjects:

Geography, 06.11.2019 07:31

Mathematics, 06.11.2019 07:31

Physics, 06.11.2019 07:31

Mathematics, 06.11.2019 07:31

Mathematics, 06.11.2019 07:31