Business, 08.03.2021 20:00 davelopez979

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (PPP) and uncovered interest parity/international Fisher effect (IFE) toforecast spot exchange rates. Omni gathers the financial information as follows:(Note: The rand (ZAR) is the South African currency. USD refers to the U. S. dollar. The base year denotes the beginning of the period.)

Base price level (any country) 100

Current U. S. price level 105

Current South African price level 111

Base rand spot exchange rate $0.175

Current rand spot exchange rate $0.158

Expected annual U. S. inflation 7%

Expected annual South African inflation 5%

Expected U. S. one-year interest rate 10%

Expected South African one-year interest rate 8%

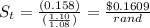

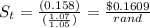

(a) According to PPP, what should the current ZAR spot rate in USD (USD/ZAR)be?

(b) According to PPP, is the U. S. dollar expected to appreciate or depreciate relativeto the rand over the year? Why?

(c) According to the UIP/IFE is the U. S. dollar expected to appreciate or depreciaterelative to the rand over the year? Why?

(d) Compare your answer in b) and c). Are you surprised? Why?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:30, joshdunsbuns143

How did lani lazzari show her investors she was a good investment? (site 1)

Answers: 3

Business, 22.06.2019 11:50, dinero0424

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 16:50, taylorb9893

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

Business, 22.06.2019 23:40, step35

When randy, a general manager of a national retailer, moved to a different store in his company that was having difficulty, he knew that sales were low and after talking to his employees, he found morale was also low. at first randy thought attitudes were poor due to low sales, but after working closely with employees, he realized that the poor attitudes were actually the cause of poor sales. randy was able to discover the cause of the problem by utilizing skills.

Answers: 2

You know the right answer?

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (P...

Questions in other subjects:

Medicine, 20.08.2020 19:01

English, 20.08.2020 19:01

Biology, 20.08.2020 19:01

Social Studies, 20.08.2020 19:01

Mathematics, 20.08.2020 19:01

whereas St will be the current level currencies,

whereas St will be the current level currencies,  was its base point currency.

was its base point currency.  would be in the home nation the market price

would be in the home nation the market price  in a different nation was its price standard.

in a different nation was its price standard.

= inflation rate in the home country

= inflation rate in the home country = inflation rate in a foreign country

= inflation rate in a foreign country

= Homeland interest rate

= Homeland interest rate = foreign country interest rate

= foreign country interest rate