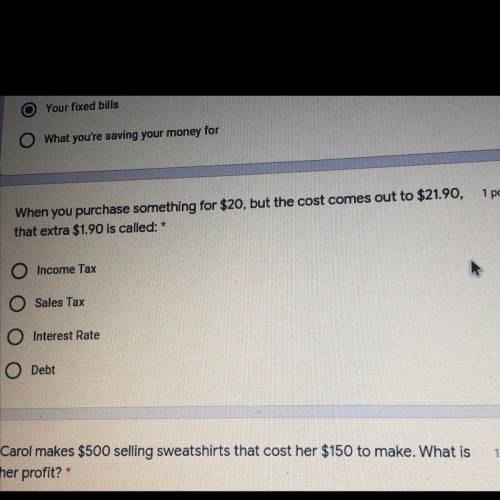

Help please and thank you

...

Business, 04.03.2021 23:50 ysbchrishoncho

Help please and thank you

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:30, emmanuelcampbel

Nellie lumpkin, who suffered from dementia, was admitted to the picayune convalescent center, a nursing home. because of her mental condition, her daughter, beverly mcdaniel, signed the admissions agreement. it included a clause requiring the par- ties to submit any dispute to arbitration. after lumpkin left the center two years later, she filed a suit against picayune to recover damages for mistreatment and malpractice. [covenant health & rehabilitation of picayune, lp v. lumpkin, 23 so.2d 1092 (miss. app. 2009)] (see page 91.) 1. is it ethical for this dispute—involving negligent medical care, not a breach of a commercial contract—to be forced into arbitration? why or why not? discuss whether medical facilities should be able to impose arbitration when there is generally no bargaining over such terms.

Answers: 3

Business, 22.06.2019 05:30, 2023greenlanden

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 06:30, brony2199

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n. v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

Business, 22.06.2019 10:30, volleyballfun24

Trecek corporation incurs research and development costs of $625,000 in 2017, 30 percent of which relate to development activities subsequent to ias 38 criteria having been met that indicate an intangible asset has been created. the newly developed product is brought to market in january 2018 and is expected to generate sales revenue for 10 years. assume that a u. s.–based company is issuing securities to foreign investors who require financial statements prepared in accordance with ifrs. thus, adjustments to convert from u. s. gaap to ifrs must be made. ignore income taxes. required: (a) prepare journal entries for research and development costs for the years ending december 31, 2017, and december 31, 2018, under (1) u. s. gaap and (2) ifrs. (c) prepare the entry(ies) that trecek would make on the december 31, 2017, and december 31, 2018, conversion worksheets to convert u. s. gaap balances to ifrs.

Answers: 1

You know the right answer?

Questions in other subjects:

English, 29.06.2019 15:40