Business, 26.02.2021 20:40 Jerryholloway5871

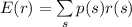

. Suppose your expectations regarding the stock price are as follows State of the Market Probability Ending Price HPR (including dividends) Boom .35 $140 44.5% Normal growth .30 110 14.0 Recession .35 80 216.5Use Equations 5.11 and 5.12 to compute the mean and standard deviation of the HPR on stocks.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 15:30, Jessicadiaz8602

Which of the following statements accurately describes how costs and benefits are calculated?

Answers: 3

Business, 23.06.2019 01:30, minecrafter3882

What is the name of the company and the stock symbol you chose? what is the p/e ratio? what information did you find about the company? why did you choose this stock? company name: stock symbol: p/e ratio: information about the company: why did you choose this stock?

Answers: 2

You know the right answer?

. Suppose your expectations regarding the stock price are as follows State of the Market Probability...

Questions in other subjects:

Mathematics, 01.12.2021 22:10

Mathematics, 01.12.2021 22:10

Health, 01.12.2021 22:10

Geography, 01.12.2021 22:10

Law, 01.12.2021 22:10

Spanish, 01.12.2021 22:10

Mathematics, 01.12.2021 22:10

![\sigma = \sqrt{\sum \limits_{s} p(s) [r(s) - E(r)]^2}](/tpl/images/1151/9367/98614.png)