Business, 24.02.2021 03:10 steven2669

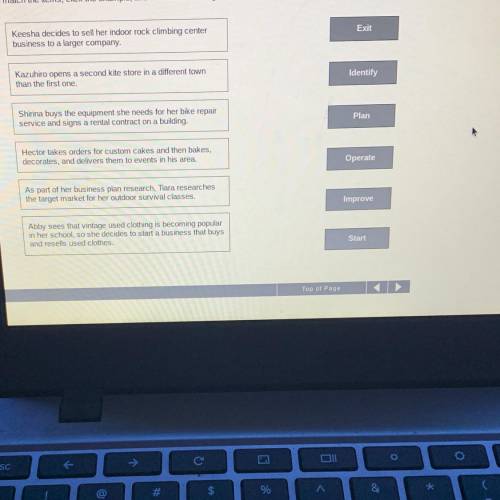

To match the items, click the example, and then click the stage.

Keesha decides to sell her indoor rock climbing center

business to a larger company.

Exit

Kazuhiro opens a second kite store in a different town

than the first one.

Identify

Shirina buys the equipment she needs for her bike repair

service and signs a rental contract on a building.

Plan

Hector takes orders for custom cakes and then bakes,

decorates, and delivers them to events in his area.

Operate

As part of her business plan research, Tiara researches

the target market for her outdoor survival classes.

Improve

Abby sees that vintage used clothing is becoming popular

in her school, so she decides to start a business that buys

and resells used clothes.

Start

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 02:20, fdasbiad

Larissa has also provided the following information. during the year, the company raised $36 million in new long-term debt and retired $20.52 million in long-term debt. the company also sold $22 million in new stock and repurchased $32.4 million. the company purchased $54 million in fixed assets, and sold $6,107,400 in fixed assets. larissa has asked dan to prepare the financial statement of cash flows and the accounting statement of cash flows. she has also asked you to answer the following questions: 1. how would you describe east coast yachts' cash flows? 2. which cash flows statement more accurately describes the cash flows at the company? 3. in light of your previous answers, comment on larissa's expansion plans.

Answers: 2

Business, 22.06.2019 06:00, aliami0306oyaj0n

Use this image to answer the following question. when the economy is operating at point b, the us congress is most likely to follow

Answers: 3

Business, 22.06.2019 08:40, jasonr182017

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 22.06.2019 17:50, nayelieangueira

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

You know the right answer?

To match the items, click the example, and then click the stage.

Keesha decides to sell her indoor...

Questions in other subjects:

Mathematics, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30

Social Studies, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30