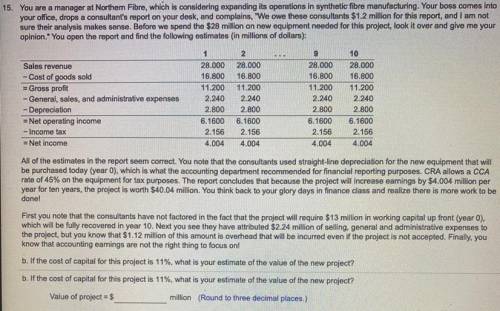

15. You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a

consultant's report on your desk, and complains, "We owe these consultants $1.2 million for this report, and I am not sure their analysis makes sense. Before

we spend the $28 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates

(in Millions of dollars):

1

2

9

10

Sales revenue

28.000 28.000

28.000 28.000

- Cost of goods sold

16.800 16.800

16.800 16.800

= Gross profit

11.200 11.200

11.200 11.200

- General, sales, and administrative expenses 2.240 2.240

2.240 2.240

- Depreciation

2.800 2.800

2.800 2.800

= Net operating income

6.1600 6.1600

6.1600 6.1600

- Income tax

2.156 2.156

2.156 2.156

= Net income

4.004 4.004

4.004 4.004

All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today

(year o), which is what the accounting department recommended for financial reporting purposes. CRA allows a CCA rate of 45% on the equipment for tax

purposes. The report concludes that because the project will increase earnings by $4.004 million per year for ten years, the project is worth $40.04 million. You

think back to your glory days in finance class and realize there is more work to be done!

First you note that the consultants have not factored in the fact that the project will require S13 million in working capital up front (year o), which will be fully

recovered in year 10. Next you see they have attributed $2.24 million of selling, general and administrative expenses to the project, but you know that $1.12

million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to

focus on!

b. If the cost of capital for this project is 11%, what is your estimate of the value of the new project?

b. If the cost of capital for this project is 11%, what is your estimate of the value of the new project?

Value of project = 5

million (Round to three decimal places.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 15:30, shaelyn0920

Walter wants to deposit $1,500 into a certificate of deposit at the end of each ofthe next 6 years. the deposits will earn 5 percent compound annual interest. ifwalter follows through with his plan, approximately how much will be in his accountimmediately after the sixth deposit is made?

Answers: 1

Business, 22.06.2019 00:00, adayisenga

Which part/word/phrase in the passage refers to a business’s financing activity seen in a cash flow statement? nathan works as an accountant in a footwear manufacturing company. he is currently preparing the cash flow statement for his employer. during the given accounting period, the company purchased raw materials worth $25,000. it also bought new equipment worth $75,000 to increase its production output. further, it borrowed a long-term bank loan of $100,000 to facilitate further expansion. finally, the company spent $50,000 on advertising its latest brand of footwear in the market. {lol i guessed its "it borrowed a long-term bank loan of $100,000 to facilitate further expansion" and thats correct}

Answers: 1

Business, 22.06.2019 11:00, neash19

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 22.06.2019 20:30, andrejr0330jr

Exercise 7-7 martinez company reports the following financial information before adjustments. dr. cr. accounts receivable $168,900 allowance for doubtful accounts $3,200 sales revenue (all on credit) 849,300 sales returns and allowances 50,440 prepare the journal entry to record bad debt expense assuming martinez company estimates bad debts at (a) 4% of accounts receivable and (b) 4% of accounts receivable but allowance for doubtful accounts had a $1,550 debit balance. (if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

Answers: 3

You know the right answer?

15. You are a manager at Northern Fibre, which is considering expanding its operations in synthetic...

Questions in other subjects:

Mathematics, 16.06.2021 07:30

History, 16.06.2021 07:30

English, 16.06.2021 07:30

Biology, 16.06.2021 07:30

Mathematics, 16.06.2021 07:30

Mathematics, 16.06.2021 07:30

Biology, 16.06.2021 07:30

Advanced Placement (AP), 16.06.2021 07:30