Business, 19.02.2021 17:00 jasminelynn135owmyj1

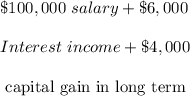

Jeremy earned $100,000 is salary and $6,000 in interest income during the year. Jeremy's employer withheld $11,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of the household and has $23,000 in itemized deductions. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000. What is Jeremy’s tax refund or tax due including the tax on the capital gain?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:50, Softball6286

Carver company produces a product which sells for $30. variable manufacturing costs are $15 per unit. fixed manufacturing costs are $5 per unit based on the current level of activity, and fixed selling and administrative costs are $4 per unit. a selling commission of 10% of the selling price is paid on each unit sold. the contribution margin per unit is:

Answers: 2

Business, 21.06.2019 22:30, petunia6548

True or false: banks are required to make electronically deposited funds available on the same day of the deposit

Answers: 2

You know the right answer?

Jeremy earned $100,000 is salary and $6,000 in interest income during the year. Jeremy's employer wi...

Questions in other subjects:

Physics, 23.03.2021 08:20

English, 23.03.2021 08:20

Mathematics, 23.03.2021 08:20

Mathematics, 23.03.2021 08:20

Biology, 23.03.2021 08:20

Biology, 23.03.2021 08:20

Mathematics, 23.03.2021 08:20

Mathematics, 23.03.2021 08:20

Mathematics, 23.03.2021 08:20

English, 23.03.2021 08:20

![22\%+ \$6,065] + \$4000\times 15\%](/tpl/images/1130/7036/d5975.png)