Business Studies

question from Edco Sample paper A junior cert Q17 ( common level ) 2020...

Business, 12.02.2021 07:50 zoeyruckel

Business Studies

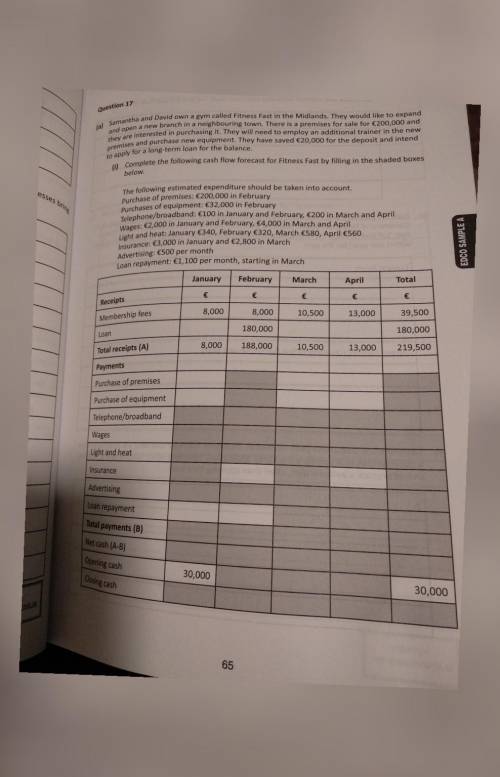

question from Edco Sample paper A junior cert Q17 ( common level ) 2020

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:00, E1nst31n44

You and your new australian bride matilda, are applying for a loan and are required to submit a balance sheet with your net worth. you own a 2008 toyota camry that you bought last month for $9,995. the kelly blue book value for this car is $13,995. you owe $8,150 on the car loan for the camry. you pay off your visa credit card every month and have not paid any credit card interest this year. the current visa credit card balance is $3,522, and the next statement is due in 15 days. you have a student loan balance of $6,500. you presently have $425 in your checking account and $1,540 in your savings account. you own 100 shares of ibm stock that you purchased for $85.50 per share. one share of ibm is now selling for $158.42. you own computers and other electronics that you purchased for $4,100 but could probably sell today on e-bay for $1,800. your gross income is $80,000 per year. what is your current net worth? (see wb ch. 2 example 2.3)

Answers: 1

Business, 22.06.2019 03:00, jamesgotqui6

Presented below is a list of possible transactions. analyze the effect of the 18 transactions on the financial statement categories indicated. transactions assets liabilities owners’ equity net income 1. purchased inventory for $80,000 on account (assume perpetual system is used). 2. issued an $80,000 note payable in payment on account (see item 1 above). 3. recorded accrued interest on the note from item 2 above. 4. borrowed $100,000 from the bank by signing a 6-month, $112,000, zero-interest-bearing note. 5. recognized 4 months’ interest expense on the note from item 4 above. 6. recorded cash sales of $75,260, which includes 6% sales tax. 7. recorded wage expense of $35,000. the cash paid was $25,000; the difference was due to various amounts withheld. 8. recorded employer’s payroll taxes. 9. accrued accumulated vacation pay. 10. recorded an asset retirement obligation. 11. recorded bonuses due to employees. 12. recorded a contingent loss on a lawsuit that the company will probably lose. 13. accrued warranty expense (assume expense warranty approach). 14. paid warranty costs that were accrued in item 13 above. 15. recorded sales of product and related service-type warranties. 16. paid warranty costs under contracts from item 15 above. 17. recognized warranty revenue (see item 15 above). 18. recorded estimated liability for premium claims outstanding.

Answers: 1

Business, 22.06.2019 13:10, Mikey3414

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

Business, 22.06.2019 22:40, deeknuk

Problem 3: access control pokeygram, a cutting-edge new email start-up, is setting up building access for its employees. there are two types of employees: managers and engineers, and there are three departments: security, networking, and human resoures. each employee works in a single department, and each department is housed on a different floor. managers are allowed access to any floor, while engineers are allowed access only to their own floor. there are three badge-operated elevators, each going up to only one distinct floor. every employee has one badge. pokeygram wants to use the best possible access control method in order to minimize delay for the elevators (a) access control matrix, 1. which of the following would you recommend that pokeygram use: (b) access control lists, or (c) capabilities? make sure to justify your answer. 2. what, if any, would be the benefits (and/or disadvantages) of using rbac (role-based access control) in this situation? keep your solution for this problem limited to 10-12 lines of text.

Answers: 2

You know the right answer?

Questions in other subjects:

Mathematics, 28.09.2021 21:50

Mathematics, 28.09.2021 21:50

Mathematics, 28.09.2021 22:00