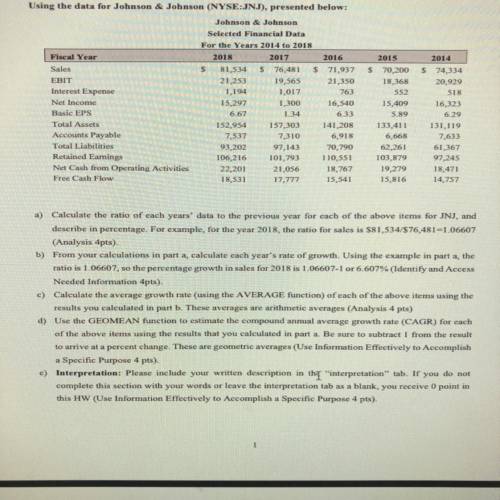

Contrast the results for the geometrie averages to these for the arithmetio average for the variables below. What do your observe about the differences in the two growth estimates for Sales and Retained Earnings? What do you observe about the differences in the two estimates for Net Cash from Operations and Net Income? Hint: Look at the results from part b (the individual yearly growth rate) for each variable to draw some conclusions about the variation between the arithmetic geometric averages

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 17:00, HourlongNine342

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 23.06.2019 02:50, achy1905

Kandon enterprises, inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. both divisions are considered separate components as defined by generally accepted accounting principles. the horse division has been unprofitable, and on november 15, 2018, kandon adopted a formal plan to sell the division. the sale was completed on april 30, 2019. at december 31, 2018, the component was considered held for sale. on december 31, 2018, the company’s fiscal year-end, the book value of the assets of the horse division was $415,000. on that date, the fair value of the assets, less costs to sell, was $350,000. the before-tax loss from operations of the division for the year was $290,000. the company’s effective tax rate is 40%. the after-tax income from continuing operations for 2018 was $550,000. required: 1. prepare a partial income statement for 2018 beginning with income from continuing operations. ignore eps disclosures. 2. prepare a partial income statement for 2018 beginning with income from continuing operations. assuming that the estimated net fair value of the horse division’s assets was $700,000, instead of $350,000. ignore eps disclosures.

Answers: 2

You know the right answer?

Contrast the results for the geometrie averages to these for the arithmetio average for the variable...

Questions in other subjects:

Mathematics, 23.12.2020 19:50

English, 23.12.2020 19:50

Mathematics, 23.12.2020 19:50

English, 23.12.2020 19:50