Business, 08.02.2021 19:00 darianhaynes

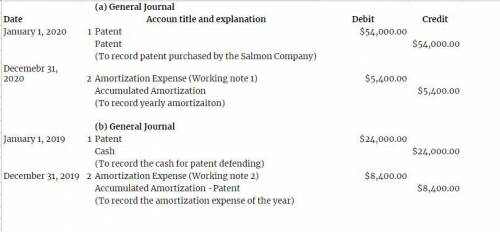

Taylor Swift Corporation purchases a patent from Salmon Company on January 1, 2020, for $54,000. The patent has a remaining legal life of 16 years. Taylor Swift feels the patent will be useful for 10 years. Prepare Taylor Swift's journal entries to record the purchase of the patent and 2020 amortization. Assume that at January 1, 2019, the carrying amount of the patent on Taylor Swift's books is $43, 200. In January, Taylor Swift spends $24,000 successfully defending a patent suit. Taylor Swift still feels the patent will be useful until the end of 2026. Prepare the journal entries to record the $24,000 expenditure and 2019 amortization.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:30, Amholloway13

Ming chen began a professional practice on june 1 and plans to prepare financial statements at the end of each month. during june, ming chen (the owner) completed these transactions. a. owner invested $61,000 cash in the company along with equipment that had a $25,000 market value. b. the company paid $1,900 cash for rent of office space for the month. c. the company purchased $15,000 of additional equipment on credit (payment due within 30 days). d. the company completed work for a client and immediately collected the $2,100 cash earned. e. the company completed work for a client and sent a bill for $7,000 to be received within 30 days. f. the company purchased additional equipment for $5,500 cash. g. the company paid an assistant $3,000 cash as wages for the month. h. the company collected $5,200 cash as a partial payment for the amount owed by the client in transaction e. i. the company paid $15,000 cash to settle the liability created in transaction c. j. owner withdrew $1,500 cash from the company for personal use. required: enter the impact of each transaction on individual items of the accounting equation. (enter decreases to account balances with a minus sign.)

Answers: 2

Business, 22.06.2019 03:40, josie122

Your parents have accumulated a $170,000 nest egg. they have been planning to use this money to pay college costs to be incurred by you and your sister, courtney. however, courtney has decided to forgo college and start a nail salon. your parents are giving courtney $20,000 to her get started, and they have decided to take year-end vacations costing $8,000 per year for the next four years. use 8 percent as the appropriate interest rate throughout this problem. use appendix a and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. how much money will your parents have at the end of four years to you with graduate school, which you will start then?

Answers: 1

Business, 22.06.2019 19:20, dayday0

Six years ago, an 80-kw diesel electric set cost $160,000. the cost index for this class of equipment six years ago was 187 and is now 194. the cost-capacity factor is 0.6. the plant engineering staff is considering a 120-kw unit of the same general design to power a small isolated plant. assume we want to add a precompressor, which (when isolated and estimated separately) currently costs $13291. determine the total cost of the 120-kw unit. (hint: skip $ and comma symbols)

Answers: 3

Business, 22.06.2019 19:30, jaybeast40

Oz makes lion food out of giraffe and gazelle meat. giraffe meat has 18 grams of protein and 36 grams of fat per pound, while gazelle meat has 36 grams of protein and 18 grams of fat per pound. a batch of lion food must contain at least "46,800" grams of protein and 70,200 grams of fat. giraffe meat costs $1/pound and gazelle meat costs $2/pound. how many pounds of each should go into each batch of lion food in order to minimize costs? hint [see example 2.]

Answers: 1

You know the right answer?

Taylor Swift Corporation purchases a patent from Salmon Company on January 1, 2020, for $54,000. The...

Questions in other subjects:

Mathematics, 21.09.2021 01:20

Mathematics, 21.09.2021 01:20

Mathematics, 21.09.2021 01:20

Mathematics, 21.09.2021 01:20

Mathematics, 21.09.2021 01:20

Mathematics, 21.09.2021 01:20