Business, 01.02.2021 23:50 Skylar8826

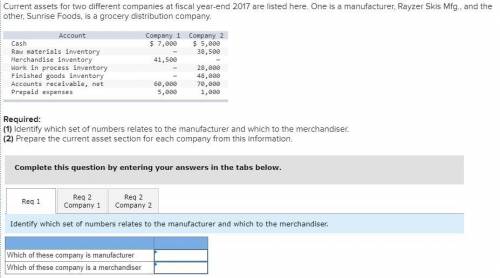

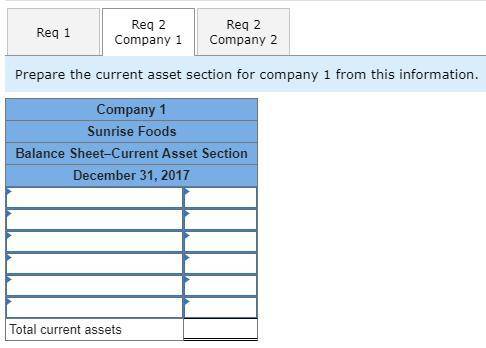

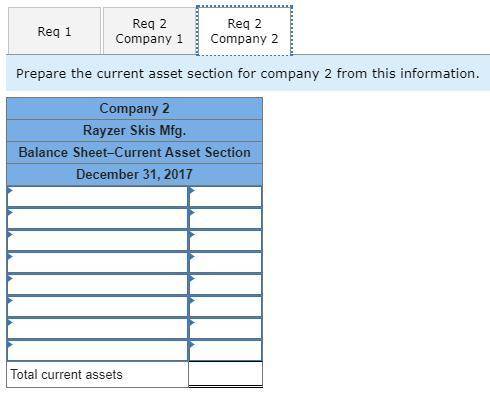

Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other, Sunrise Foods, is a grocery distribution company. Account Company 1 Company 2 Cash $ 13,000 $ 11,000 Raw materials inventory — 46,750 Merchandise inventory 49,750 — Work in process inventory — 34,000 Finished goods inventory — 54,000 Accounts receivable, net 58,000 72,000 Prepaid expenses 2,500 500 Required: 1. Identify which set of numbers relates to the manufacturer and which to the merchandiser. 2a. & 2b. Prepare the current asset section for each company from this information.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:40, Patricia2121

•broussard skateboard’s sales are expected to increase by 15% from $8 million in 2016 to $9.2 million in 2017. its assets totaled $5 million at the end of 2016. broussard is already at full capacity, so its assets must grow at the same rate as projected sales. at the end of 2016, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. the after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 40%. use the afn equation to forecast broussard’s additional funds needed for the coming year

Answers: 2

Business, 22.06.2019 11:50, dinero0424

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 12:40, daphnewibranowsky

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

You know the right answer?

Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer...

Questions in other subjects:

English, 06.05.2020 01:46

Chemistry, 06.05.2020 01:46

Mathematics, 06.05.2020 01:46

Mathematics, 06.05.2020 01:46