The following information was taken from the accounting records of Elliott Manufacturing Corp. Unfortunately, some of the data were destroyed by a computer malfunction.

Sales Revenue $ 61,750

Finished Goods Inventory, Beginning 10,250

Finished Goods Inventory, Ending 7,000

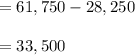

Cost of Goods Sold ?

Gross Margin 28,250

Direct Materials Used 10,750

Selling and Administrative Expense ?

Operating Income 15,000

Work-in-Process Inventory, Beginning ?

Work-in-Process Inventory, Ending 5,750

Direct Labor Used 19,375

Factory Overhead 12,500

Total Manufacturing Cost ?

Cost of Goods Manufactured ?

Cost of goods sold is calculated to be:.

a. $30.250

b. $32,500

c. $33.500

d. $27,500

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 15:30, gwoodbyrne

Thirty years ago daniel bought a plot of land for $50,000 when the cpi was 50. now the cpi is 180 and he sold the land for $180,000. what issue might inflation cause for daniel?

Answers: 2

Business, 22.06.2019 01:20, nonjabulomabaso7423

For a multistate lottery, the following probability distribution represents the cash prizes of the lottery with their corresponding probabilities. complete parts (a) through (c) below. x (cash prize, $) p(x) grand prizegrand prize 0.000000008860.00000000886 200,000 0.000000390.00000039 10,000 0.0000016950.000001695 100 0.0001582930.000158293 7 0.0039114060.003911406 4 0.0080465690.008046569 3 0.012865710.01286571 0 0.975015928140.97501592814 (a) if the grand prize is $13 comma 000 comma 00013,000,000, find and interpret the expected cash prize. if a ticket costs $1, what is your expected profit from one ticket? the expected cash prize is $nothing.

Answers: 3

Business, 22.06.2019 04:00, tmcdowell69

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 09:40, shybug886

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

You know the right answer?

The following information was taken from the accounting records of Elliott Manufacturing Corp. Unfor...

Questions in other subjects:

English, 06.05.2021 19:30

Physics, 06.05.2021 19:30

Mathematics, 06.05.2021 19:30