Business, 13.01.2021 15:40 smithjirrah

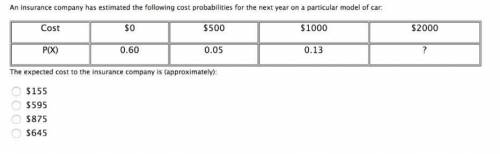

A publishing company has estimated the following cost probability distribution for the next year. What is the expected cost to the publishing company

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 14:20, mmczora22

On january 1, 2015, jon sports has a bond payable of $200,000. during 2015, it pays off $20,000 of the outstanding bond principal and issues a new $70,000 bond. there are no other transactions related to the bond payable account. what is jon sports' december 31, 2015, bond payable balance?

Answers: 2

Business, 22.06.2019 02:30, tdyson3p6xvtu

The dollar value generated over decades of customer loyalty to your company is known as brand equity. viability. sustainability. luck.

Answers: 1

Business, 22.06.2019 08:20, XAINEE

Suppose that jim plans to borrow money for an education at texas a& m university. jim will need to borrow $25,000 at the end of each year for the next five years (total=$125,000). jim wishes his parents could pay for his education but they can’t. at least, he qualifies for government loans with a reduced interest rate while he is in school. he has a special arrangement with aggiebank to lend him the money at a subsidized rate of 1% over five years without having to make a payment until the end of the fifth year. however, at the end of the fifth year, jim agrees to pay off the loan by borrowing from longhorn bank. longhorn bank will lend him the money he needs at an annual interest rate of 6%. jim agrees to pay back the longhorn bank with 20 annual payments and the payments will be uniform (equal annual payments including principal and interest). (i) calculate how much money jim has to borrow at the end of 5 years to pay off the loan with aggiebank. a. $121,336 b. $127,525 c. $125,000 d. $102,020 e. none of the above

Answers: 2

Business, 22.06.2019 09:50, anonymous777739

Beck company had the following accounts and balances at the end of the year. what is net income or net loss for the year? cash $ 74 comma 000 accounts payable $12,000 common stock $21,000 dividends $12,000 operating expenses $ 13 comma 000 accounts receivable $ 49 comma 000 inventory $ 47 comma 000 longminusterm notes payable $33,000 revenues $ 91 comma 000 salaries payable $ 30 comma 000

Answers: 1

You know the right answer?

A publishing company has estimated the following cost probability distribution for the next year. Wh...

Questions in other subjects:

Mathematics, 22.10.2019 00:10

Geography, 22.10.2019 00:10

English, 22.10.2019 00:10

Social Studies, 22.10.2019 00:10

Mathematics, 22.10.2019 00:10

Health, 22.10.2019 00:10

World Languages, 22.10.2019 00:10