Business, 02.12.2020 01:30 algahimnada

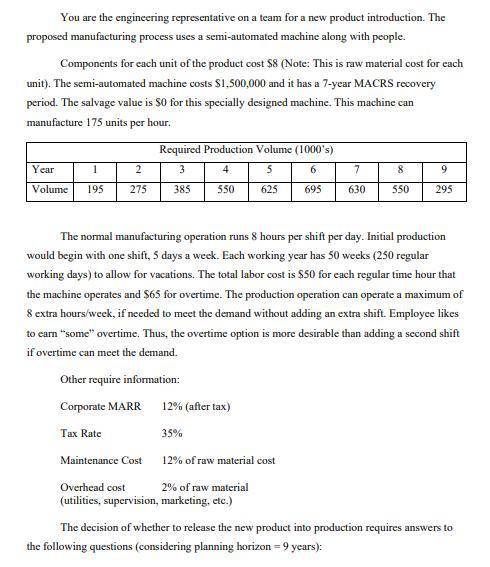

If variability of selling price per unit (consider current selling price is $10.50 per unit)

may range from -15% to +15% (i. e. selling price per unit cannot decrease by less than

15% of the current selling price and cannot increase by more that 15% of the current

selling price) and variability of raw material cost per unit (consider raw material cost per

unit as $8) may range from -15% to +15%, find After-Tax Net Present Value (ATNPV)

ATMARR 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25%

ATNPV

Raw Material Cost/Unit 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12

ATNPV

Selling Price/Unit 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12

ATNPV

for simultaneous change in selling price and raw material cost to fill the table below

(consider After-Tax MARR is 12%):

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 14:40, blackkiki5588

Lohn corporation is expected to pay the following dividends over the next four years: $18, $14, $13, and $8.50. afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. if the required return on the stock is 14 percent, what is the current share price?

Answers: 2

Business, 21.06.2019 21:00, kenneditomejia

Which of the following statements is correct? a) due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u. s. businesses (in terms of number of businesses) are organized as corporationsb) most businesses (by number and total dollar sales) are organized as proprietorships or corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, primarily because corporations have important tax advantages over proprietorships and partnerships. c) due to legal considerations related to ownership transfers and limited liability, which affect the ability to attract capital, most business (measured by dollar sales) is conducted by corporations in spite of large corporations' less favorable tax treatmentd) large corporations are taxed more favorably than proprietorshipse) corporate stockholders are exposed to unlimited liability

Answers: 2

Business, 22.06.2019 00:00, kyllow5644

Which of the following is a disadvantage to choosing a sole proprietorship business structure? question 9 options: the owner has personal responsibility for the company's liabilities. the owner has to share the profits with partners. the owner is still liable for personal debts. the owner has to report to shareholders.

Answers: 1

You know the right answer?

If variability of selling price per unit (consider current selling price is $10.50 per unit)

may ra...

Questions in other subjects:

Biology, 09.06.2020 09:57

English, 09.06.2020 09:57

Social Studies, 09.06.2020 09:57

History, 09.06.2020 09:57

Mathematics, 09.06.2020 09:57

Chemistry, 09.06.2020 09:57

Biology, 09.06.2020 09:57

Mathematics, 09.06.2020 09:57

Mathematics, 09.06.2020 09:57