Business, 01.12.2020 02:10 kingalex7575

Suppose that in a country politicians feel that interest rates are too high and they advocate a greater rate of growth of the money supply to decrease the interest rate.

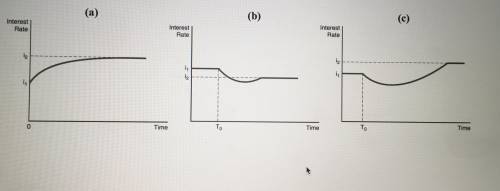

Figure (a) illustrates the effect of an increased rate of money supply growth at time period 0.

Figures (b) and (c) illustrate the effect of an increased rate of money supply growth at time period T0.

i) If a decline in interest rates is desired, in which case (a, b or c) an increase in money supply growth should be called for? Explain, why?

ii) In which case (a, b or c) a decrease in money growth is appropriate to decrease the interest rate immediately? Explain, why?

iii) If the policymakers care more about the low interest rates in the long-run, in which case (a, b or c) a decrease in money growth is appropriate? Explain, why?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:20, LadyHolmes67

Sye chase started and operated a small family architectural firm in 2016. the firm was affected by two events: (1) chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. there were $250 of supplies on hand as of december 31, 2016. record the two transactions in the accounts. record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. post the entries in the t-accounts and prepare a post-closing trial balance.

Answers: 1

Business, 22.06.2019 18:00, 20jhuffman

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

Business, 22.06.2019 19:40, gakodir

Last year ann arbor corp had $155,000 of assets, $305,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 37.5%. the new cfo believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. assets, sales, and the debt ratio would not be affected. by how much would the cost reduction improve the roe? a. 11.51%b. 12.11%c. 12.75%d. 13.42%e. 14.09%

Answers: 3

Business, 22.06.2019 20:00, ethanyayger

Acompetitive market in healthcare would a. overprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers b. underprovide healthcare because it would eliminate medicare and medicaid c. underprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers d. overprovide healthcare because it would be similar to the approach used in canada

Answers: 1

You know the right answer?

Suppose that in a country politicians feel that interest rates are too high and they advocate a grea...

Questions in other subjects:

Social Studies, 07.11.2019 17:31

Mathematics, 07.11.2019 17:31

Mathematics, 07.11.2019 17:31

Spanish, 07.11.2019 17:31

Social Studies, 07.11.2019 17:31

Mathematics, 07.11.2019 17:31