Business, 22.10.2020 16:01 darnellgee298

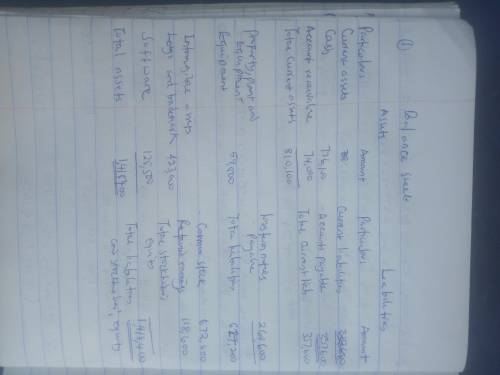

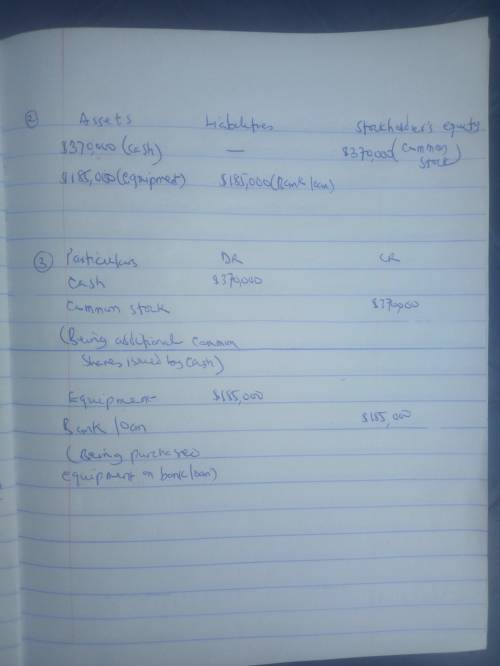

The following is a list of account balances for Pick-A-Pet, Inc., as of June 30, Year 3: Accounts Payable $ 357,600 Accounts Receivable 74,000 Cash 736,100 Common Stock 672,600 Equipment 59,800 Logo and Trademarks 423,000 Long-term Notes Payable 269,600 Retained Earnings 118,600 Software 125,500 The company entered into the following transactions during July, Year 3. Stockholders contribute $370,000 cash for additional ownership shares and the company borrows $185,000 in cash from a bank to buy new equipment by signing a formal agreement to repay the loan in 2 years. No other transactions took place during July, Year 3. Required: Prepare a classified balance sheet for the company at June 30, Year 3. Show the effects of the July transactions on the basic accounting equation. Prepare the journal entries that would be used to record the transactions.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 16:30, crystalclear99

Aland development company purchases several acres of land adjacent to a wildlife reserve. it plans to build a new community, complete with shops and schools. green sands, a local environmental group, complains that the company's proposed building methods will disrupt the area's ecological balance. the company wants to respect the local ecology but also wants to build its development. the company decides to schedule a meeting with green sands's representatives to make choices about the property that are agreeable to both sides. which strategy would be most effective in this situation?

Answers: 2

Business, 22.06.2019 05:40, Jenan25

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

Business, 22.06.2019 17:30, gghkooo1987

An essential element of being receptive to messages is to have an open mind true or false

Answers: 2

You know the right answer?

The following is a list of account balances for Pick-A-Pet, Inc., as of June 30, Year 3: Accounts Pa...

Questions in other subjects:

Mathematics, 08.07.2019 21:00

Advanced Placement (AP), 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

Biology, 08.07.2019 21:00