Business, 15.10.2020 09:01 ayoismeisalex

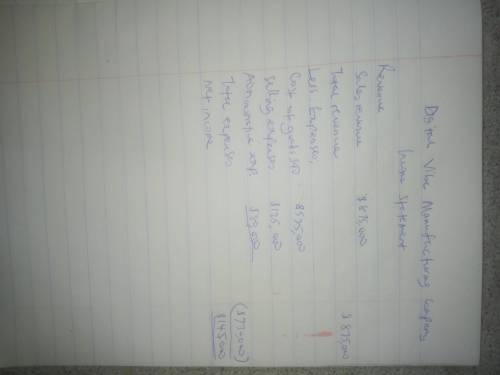

The following events took place for Digital Vibe Manufacturing Company during January, the first month of its operations as a producer of digital video monitors:a. Purchased $168,500 of materialsb. Used $149,250 of direct materials in production. c. Incurred $360,000 of direct labor wages. d. Incurred $120,000 of factory overhead. e. Transferred $600,000 of work in process to finished goods. f. Sold goods for $875,000.g. Sold goods with a cost of $525,000.h. Incurred $125,000 of selling expense. i. Incurred $80,000 of administrative expense. Required:Using the information given, complete the following:A. Prepare the January income statement for Digital Vibe Manufacturing Company. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. B.Determine the Materials Inventory, Work in Process Inventory, and Finished Goods Inventory balances at the end of the first month of operations. Labels and Amount description:LabelsFor the Month Ended January 31For the Year Ended January 31January 31Amount expensesCost of goods soldGross profitNet incomeRevenuesSelling expenses

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:30, aquinomoises518

Maker-bot corporation has 10,000 shares of 10%, $90 par value, cumulative preferred stock outstanding since its inception. no dividends were declared in the first two years. if the company pays $400,000 of dividends in the third year, how much will common stockholders receive?

Answers: 2

Business, 22.06.2019 16:20, AnhQNguyen6764

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 22.06.2019 17:40, briannagiddens

Adamson company manufactures four lines of garden tools. as a result of an activity analysis, the accounting department has identified eight activity cost pools. each of the product lines is produced in large batches, with the whole plant devoted to one product at a time. classify each of the following activities or costs as either unit-level, batch-level, product-level, or facility-level. activities (a) machining parts. (b) product design. (c) plant maintenance. (d) machine setup. (e) assembling parts. (f) purchasing raw materials. (g) property taxes. (h) painting.

Answers: 2

You know the right answer?

The following events took place for Digital Vibe Manufacturing Company during January, the first mon...

Questions in other subjects:

Mathematics, 18.05.2021 23:00

SAT, 18.05.2021 23:00

Chemistry, 18.05.2021 23:00

Mathematics, 18.05.2021 23:00

Mathematics, 18.05.2021 23:00

Biology, 18.05.2021 23:00

Mathematics, 18.05.2021 23:00