Business, 15.10.2020 07:01 Mochalav6675

John Roberts is 51 years old and has been asked to accept early retirement from his company. On July 1, the company offered John three alternative compensation packages to induce John to retire:

1. $180,000 cash payment to be paid immediately.

2. A 16-year annuity of $18,000 beginning immediately.

3. A 10-year annuity of $52,000 beginning on July 1 of the year John reaches age 61 (after 10 years).

Required:

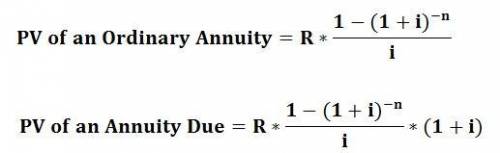

Determine the present value, assuming that he is able to invest funds at a 7% rate, which alternative should John choose?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:50, laxraAragon

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 20:00, enriqueliz1680

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

Business, 23.06.2019 00:50, chancho3703

Amanufacturing firm is considering overhauling the existing compensation strategy. currently every front line employee who works on the assembly line earns the same hourly wage. ideally, management would like to institute a new pay system that involves pay-for-performance. which of the following recommendations is both consistent with scientific management's general emphases and generally good advice for management of this firma. the firm should adopt a differential pay system with one pay level for average performance, and a higher level for good performance. b. the firm should adopt a differential pay system, but the firm should modify it from its original design and provide many different levels of pay associated with different performance levels. c. the firm should understand worker psychology and to focus on pay as the key motivator. d. all of the abovee. none of the above

Answers: 1

Business, 23.06.2019 01:00, shelovejaylocs

Why does the downward-sloping production possibilities curve imply that factors of production are scarce?

Answers: 1

You know the right answer?

John Roberts is 51 years old and has been asked to accept early retirement from his company. On July...

Questions in other subjects:

History, 12.08.2020 04:01

English, 12.08.2020 04:01

Spanish, 12.08.2020 04:01

Mathematics, 12.08.2020 04:01