Business, 13.10.2020 04:01 deadslinger5134

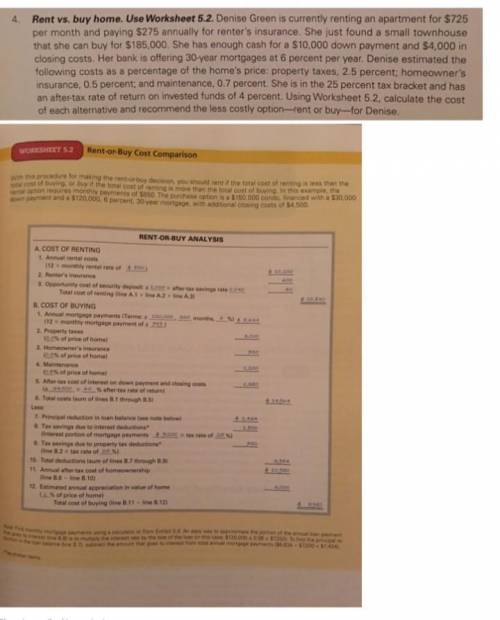

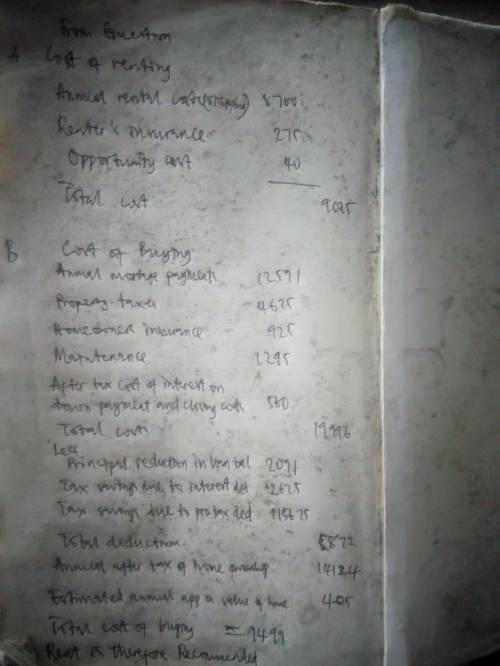

Use Worksheet 5.2 and Exhibit 5.9. Denise Green is currently renting an apartment for $650 per month and paying $400 annually for renters insurance. She just found a small townhouse she can buy for $175,000. She has enough cash for a $10,000 down payment and $4,200 in closing costs. Denise estimated the following costs as a percentage of the homes price: property taxes, 2.5 percent; homeowners insurance, 0.5 percent; and maintenance, 0.7 percent. She is in the 25 percent tax bracket. Using Worksheet 5.2, calculate the cost of each alternative and recommend the least costly option - rent or buy - for Denise. Assume Denises security deposit is equal to one months rent of $650. Also assume a 4% after tax rate return on her savings, a 3% annual appreciation in home price, and a 6% mortgage interest rate for 30 years.1. Cost of renting. Round the answer to the nearest dollar.

$

2. Cost of buying. Round the answer to to the nearest dollar.

$

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 14:20, pr47723

It is week 1 and there are currently 20 as in stock. we need 300 as at the start of week 5. if there are scheduled receipts planned for week 3 and week 4 of 120 as each and a has a lead time of 1 week, when and how large of an order should be placed to meet the requirement of 300 as?

Answers: 3

Business, 22.06.2019 04:10, jennifer9983

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company’s discount rate is 18%. after careful study, oakmont estimated the following costs and revenues for the new product: cost of equipment needed $ 230,000 working capital needed $ 84,000 overhaul of the equipment in year two $ 9,000 salvage value of the equipment in four years $ 12,000 annual revenues and costs: sales revenues $ 400,000 variable expenses $ 195,000 fixed out-of-pocket operating costs $ 85,000 when the project concludes in four years the working capital will be released for investment elsewhere within the company. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

Answers: 2

Business, 22.06.2019 06:50, jungcoochie101

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 22.06.2019 18:00, 20jhuffman

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

You know the right answer?

Use Worksheet 5.2 and Exhibit 5.9. Denise Green is currently renting an apartment for $650 per month...

Questions in other subjects:

English, 10.12.2020 17:40

Mathematics, 10.12.2020 17:40

Chemistry, 10.12.2020 17:40

Mathematics, 10.12.2020 17:40

Mathematics, 10.12.2020 17:40

Mathematics, 10.12.2020 17:40

Mathematics, 10.12.2020 17:40

Chemistry, 10.12.2020 17:40