Business, 13.10.2020 04:01 guzmanfeliciti

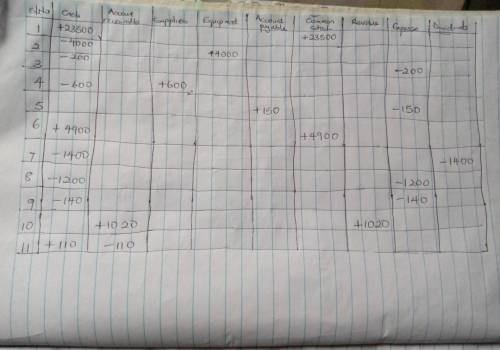

Windsor, Inc. was started on May 1. A summary of May transactions is presented below.

1. Stockholders invested $23,500 cash in the business in exchange for common

stock.

2. Purchased equipment for $4,000 cash.

3. Paid $200 cash for May office rent.

4. Paid $600 cash for supplies.

5. Incurred $150 of advertising costs in the Beacon News on account.

6. Received $4,900 in cash from customers for repair service.

7. Declared and paid a $1,400 cash dividend.

8. Paid part-time employee salaries $1,200.

9. Paid utility bills $140.

10. Performed repair services worth $1,020 on account.

11. Collected cash of $110 for services billed in transaction (10).

Required:

Prepare a tabular analysis of the transactions. Revenue is called service revenue.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 04:50, smeeden

Allie and sarah decided that they want to purchase renters insurance for the apartment they share. they made a list of all of the items to be covered by the insurance policy, along with their estimated values. if the items to be covered total more than $3000, the insurance company charges an annual premium of 23% of the total value of the items. if the items to be covered total $3000 or less, the insurance company charges an annual premium of 20% of the total value of the items.

Answers: 1

Business, 22.06.2019 05:00, nkazmirski3229

At which stage would you introduce your product to the market at large? a. development stage b. market testing stage c. commercialization stage d. ideation stage

Answers: 3

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 16:30, allytrujillo20oy0dib

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

You know the right answer?

Windsor, Inc. was started on May 1. A summary of May transactions is presented below.

1. Stockholde...

Questions in other subjects:

Biology, 30.06.2019 12:00

Biology, 30.06.2019 12:00

Mathematics, 30.06.2019 12:00

Social Studies, 30.06.2019 12:00

Biology, 30.06.2019 12:00

History, 30.06.2019 12:00

Physics, 30.06.2019 12:00