Assignment 2

(20 points)

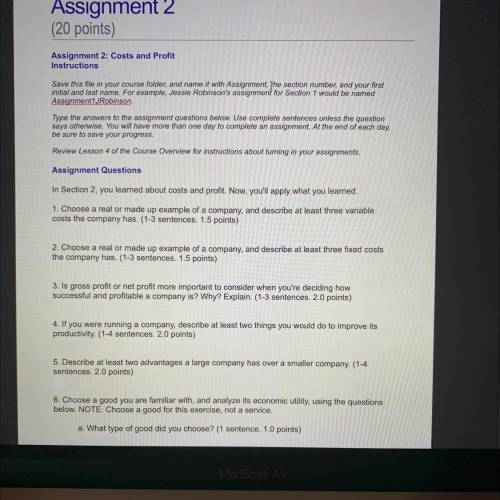

Assignment 2: Costs and Profit

Instructions

Save this fi...

Business, 11.10.2020 14:01 Falconpride847

Assignment 2

(20 points)

Assignment 2: Costs and Profit

Instructions

Save this file in your course folder and name it with Assignment, the section number, and your first

Initial and last name. For example, Jossie Robinson's assignment for Section 1 would be named

Assignment Robinson

Type the answers to the assignment questions below. Use complete sentences unless the question

says otherwise. You will have more than one day to complete an assignment. At the end of each day,

be sure to save your progress

Review Lesson 4 of the Course Overview for instructions about turning in your assignments.

Assignment Questions

In Section 2, you learned about costs and profit. Now, you'll apply what you learned.

1. Choose a real or made up example of a company, and describe at least three variable

costs the company has. (1-3 sentences. 1.5 points)

2. Choose a real or made up example of a company, and describe at least three fixed costs

the company has. (1-3 sentences. 1.5 points)

3. Is gross profit or net profit more important to consider when you're deciding how

successful and profitable a company is? Why? Explain. (1-3 sentences 2.0 points)

4. If you were running a company, describe at least two things you would do to improve its

productivity. (1-4 sentences 2.0 points)

5. Describe at least two advantages a large company has over a smaller company. (1-4

sentences 2.0 points)

6. Choose a good you are familiar with, and analyze its economic utility, using the questions

below. NOTE: Choose a good for this exercise, not a service,

a. What type of good did you choose? (1 sentence. 1.0 points)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 08:30, BigDough9090

Acompany recorded a check in its accounting records as $87. however, the check was actually written for $78 and it cleared the bank as $78. what adjustment is needed to the personal statement? a. decrease by $9 b. increase by $9 c. decrease by $18 d. increase by $9

Answers: 2

Business, 22.06.2019 11:20, murarimenon

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

Business, 22.06.2019 11:30, zahradawkins2007

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

Business, 22.06.2019 13:30, OnWheels

After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of schenkel enterprises. unfortunately, you will be the only person voting for you. the company has 375,000 shares outstanding, and the stock currently sells for $40, if there are four seats in the current election, how much will it cost you to buy a seat?

Answers: 2

You know the right answer?

Questions in other subjects:

Mathematics, 25.01.2020 14:31

Geography, 25.01.2020 14:31