Business, 08.10.2020 01:01 19jcormier

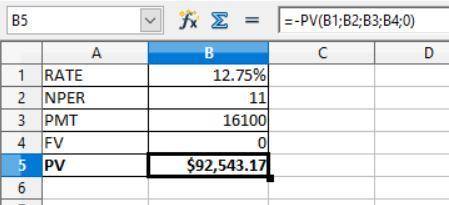

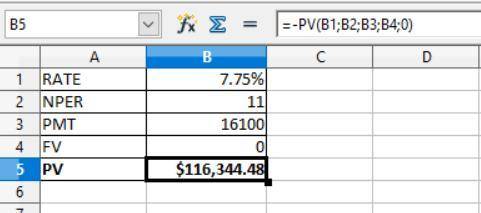

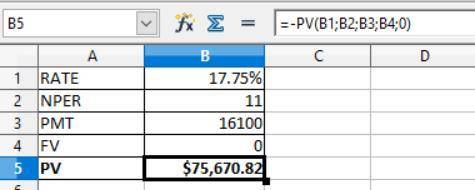

Suppose you just bought an annuity with 11 annual payments of $16,100 at the current interest rate of 12.75 percent per year. a. What is the value of the investment at the current interest rate of 12.75 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. What happens to the value of your investment if interest rates suddenly drop to 7.75 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. What happens to the value of your investment if interest rates suddenly rise to 17.75 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:00, homeschool0123

Your assessment tool contains rich data about child progress in language and literacy but no details to explain the differences between children. you decide to: a. replace the tool with another b. analyze the data using factors such as language, ability, and participation rates c. review your anecdotal notations regarding language and literacy development d. talk with families about what they are seeing at home

Answers: 2

Business, 22.06.2019 10:10, hausofharris

Karen is working on classifying all her company’s products in terms of whether they have strong or weak market share and whether this share is in a slow or growing market. what type of strategic framework is she using?

Answers: 2

Business, 22.06.2019 11:30, emocow

1. regarding general guidelines for the preparation of successful soups, which of the following statements is true? a. thick soups made with starchy vegetables may thin during storage. b. soups should be seasoned throughout the cooking process. c. finish a cream soup well before serving it to moderate the flavor. d. consommés take quite a long time to cool. student c incorrect

Answers: 2

You know the right answer?

Suppose you just bought an annuity with 11 annual payments of $16,100 at the current interest rate o...

Questions in other subjects:

History, 05.05.2020 14:33

Mathematics, 05.05.2020 14:33

Mathematics, 05.05.2020 14:33

Mathematics, 05.05.2020 14:33

History, 05.05.2020 14:33

Arts, 05.05.2020 14:33