Business, 20.09.2020 14:01 tessthetoast

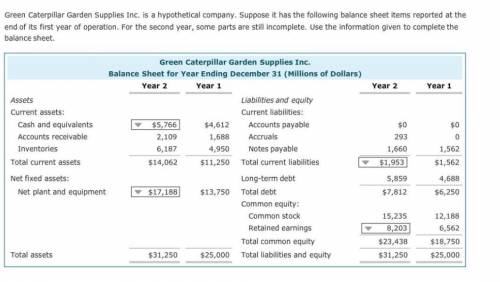

Based on your understanding of the different items reported on the balance sheet and the information they provide, which statement regarding Green Caterpillar Garden Supplies Inc.’s balance sheet is consistent with U. S. Generally Accepted Accounting Principles (GAAP)? The company’s debts should be listed in order of their liquidity. The company’s debts should be listed from those carrying the largest balance to those with the smallest balance. The company’s debts are listed in the order in which they are to be repaid.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:00, JamierW2005

Identify the accounting assumption or principle that is described below. (a) select the accounting assumption or principle is the rationale for why plant assets are not reported at liquidation value. (note: do not use the historical cost principle.) (b) select the accounting assumption or principle indicates that personal and business record-keeping should be separately maintained. (c) select the accounting assumption or principle assumes that the dollar is the "measuring stick" used to report on financial performance. (d) select the accounting assumption or principle separates financial information into time periods for reporting purposes. (e) select the accounting assumption or principle measurement basis used when a reliable estimate of fair value is not available. (f) select the accounting assumption or principle dictates that companies should disclose all circumstances and events that make a difference to financial statement users.

Answers: 3

Business, 22.06.2019 09:40, bennett2968

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 10:20, jjimenez0276

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 2

Business, 22.06.2019 10:50, dbhuggybearow6jng

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

You know the right answer?

Based on your understanding of the different items reported on the balance sheet and the information...

Questions in other subjects:

English, 16.12.2020 18:10

Social Studies, 16.12.2020 18:10

German, 16.12.2020 18:10

English, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10