Business, 05.09.2020 07:01 Isaiahplater27

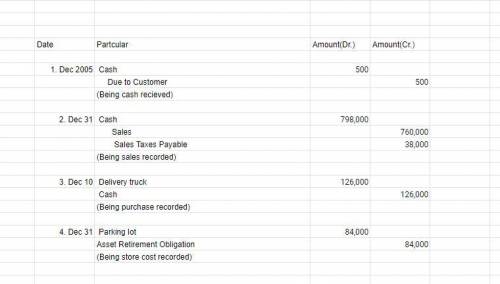

Listed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. 3. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. 4.The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Schultz estimates the fair value of the obligation at December 31 is $84,000. InstructionsPrepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry. For simplicity, assume that adjusting entries are recorded only once a year on December 31.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 07:30, cacaface311

Miko willingly admits that she is not an accountant by training. she is concerned that her balance sheet might not be correct. she has provided you with the following additional information. 1. the boat actually belongs to miko, not to skysong, inc.. however, because she thinks she might take customers out on the boat occasionally, she decided to list it as an asset of the company. to be consistent, she also listed as a liability of the corporation her personal loan that she took out at the bank to buy the boat. 2. the inventory was originally purchased for $27,500, but due to a surge in demand miko now thinks she could sell it for $39,600. she thought it would be best to record it at $39,600. 3. included in the accounts receivable balance is $11,000 that miko loaned to her brother 5 years ago. miko included this in the receivables of skysong, inc. so she wouldn’t forget that her brother owes her money. (b) provide a corrected balance sheet for skysong, inc.. (hint: to get the balance sheet to balance, adjust stockholders’ equity.) (list assets in order of liquidity.)

Answers: 1

Business, 22.06.2019 22:40, songulakabulut1992

Which of the following will not cause the consumption schedule to shift? a) a sharp increase in the amount of wealth held by households b) a change in consumer incomes c) the expectation of a recession d) a growing expectation that consumer durables will be in short supply

Answers: 1

You know the right answer?

Listed below are selected transactions of Schultz Department Store for the current year ending Decem...

Questions in other subjects:

Social Studies, 02.12.2020 14:00

Mathematics, 02.12.2020 14:00

Social Studies, 02.12.2020 14:00