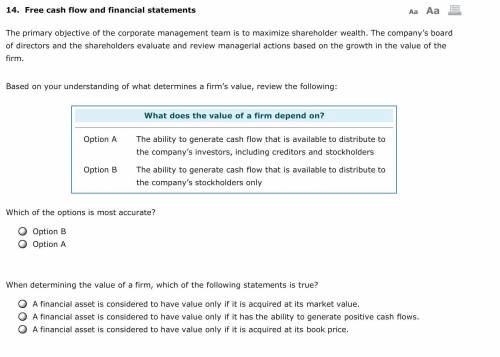

Free cash flow and financial statements The primary objective of the corporate management team is to maximize shareholder wealth. The company's board of directors and the shareholders evaluate and review managerial actions based on the growth in the value of the firm. Based on your understanding of what determines a firm's value, review the following: What does the value of a firm depend on? A. The ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders. B. The ability to generate cash flow that is available to distribute to the company's stockholders only. Which of the options is most accurate? 1. Option A.2. Option B. When determining the value of a firm, which of the following statements is true? A. Investors are risk neutral. Other things being equal, they prefer to pay more for stocks that are less risky and have uncertain cash flows. B. Investors love risk. other things being equal, they prefer to pay more for stocks that are riskier and have uncertain cash flows. C. Investors are risk averse. other things being equal, they prefer to pay more for stocks that are less risky and that have relatively more certain cash flows than other stocks. Managers strive to increase the value of a firm. An increase in the intrinsic value of the firm's stocks is a good measure of the increase in the value of the firm. Intrinsic value of a firm's stock price is determined by calculating the present values of its free cash flows (FCF) discounted at a rate called the weighted average cost of capital (WACC). Tyler is a team member in Corporate Finance at a digital-content production company. He is required to forecast the free cash flows that the company will be able to generate in the next three years. Tyler takes into account only the following equation in his calculation: FCF = Sales Revenues - Operating Costs - Operating Taxes Will his calculation be an appropriate estimate of the FCF? A. Yes. B. No. Why or why not? A. Because his calculation fails to include the increase in the working capital required to grow sales. B. Because his calculation fails to recognize the increase in sales revenues. C. Because his calculation fails to include the value of the debt that the firm carries on its balance sheet. D. Because his calculation fails to include the costs of the firm's interest and dividend payments.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 18:10, maddihamidou

Consumers who participate in the sharing economy seem willing to interact with total strangers. despite safety and privacy concerns, what do you think is the long-term outlook for this change in the way we think about interacting with people whom we don't know? how can businesses to diminish worries some people may have about these practices?

Answers: 1

Business, 22.06.2019 19:40, QueenNerdy889

An increase in the market price of men's haircuts, from $16 per haircut to $26 per haircut, initially causes a local barbershop to have its employees work overtime to increase the number of daily haircuts provided from 20 to 25. when the $26 market price remains unchanged for several weeks and all other things remain equal as well, the barbershop hires additional employees and provides 40 haircuts per day. what is the short-run price elasticity of supply? nothing (your answer should have two decimal places.) what is the long-run price elasticity of supply? nothing (your answer should have two decimal places.)

Answers: 1

You know the right answer?

Free cash flow and financial statements The primary objective of the corporate management team is to...

Questions in other subjects:

History, 23.04.2020 19:10

English, 23.04.2020 19:10

Mathematics, 23.04.2020 19:10

Chemistry, 23.04.2020 19:10